Contents

- Overview

- PCI SAQ

- SAQ A

- SAQ A-EP

- SAQ D

- Hosted Payment Page

- HPP Walkthrough

- HPP & 3D Secure

- HPP & FPRN

- iframe Embedded HPP

- Paylink via API

- Drop-In

- Hosted Fields

- Form Post

- Form Post Walkthrough

- Form Post & 3D Secure

- Form Post & FPRN

- AJAX Post

- AJAX Post Walkthrough

- AJAX Post & 3D Secure

- AJAX Post & FPRN

- Server Side Post

- Server Side Post Walkthrough

- Server Side Post & 3D Secure

- Server Side Post & FPRN

- 3D Secure

- 3D Secure v2

- Liability Shift

- 3D Secure Authentication

- Browser-Based Authentication

- Decoupled Authentication

- Out of Band Authentication

- Frictionless vs Challenge

- 3D Secure v2 Challenge Preference

- Non-Payment Authentication

- Strong Customer Authentication

- Merchant requested vs Automatic exemptions

- Testing 3D Secure

- 3D Secure Fields

- 3D Secure & Risk Management

- Fail Proof Result Notification

- Stored Card

- 3D Secure & Rebilling

- Stored Card Tokens

- Supported Payment Methods

- Stored Card Implementation

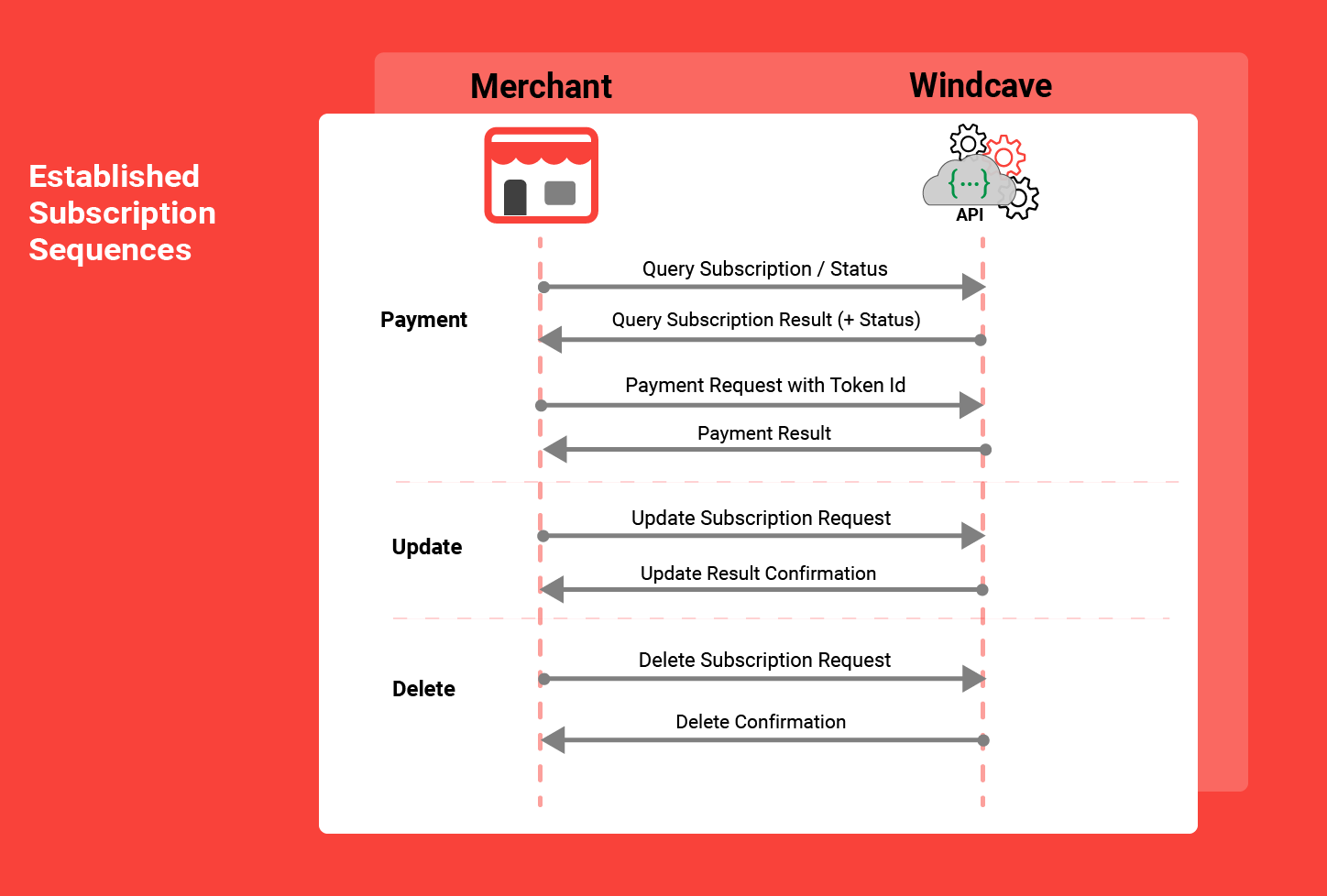

- Subscription Invoices

- Implementing Subscription Invoices

- Create Subscription

- Update Subscription

- Delete Subscription

- Query Subscription

- Query Customer

- Query Invoice

Overview

You can review the Windcave REST API reference for detailed API functions and message explanations.

For detailed information about integration models, features, functionality and detail about getting started with REST API please review the below page.

To get started with your Windcave REST API integration you will need a development account, to setup a new account please contact the sales team for a quote and complete the requirements gathering form to request development credentials.

Once signed up our team will create development credentials based on the requirements provided in the above form, we will provide a API username and API Key; both of which must be securely transferred and stored on your web-server.

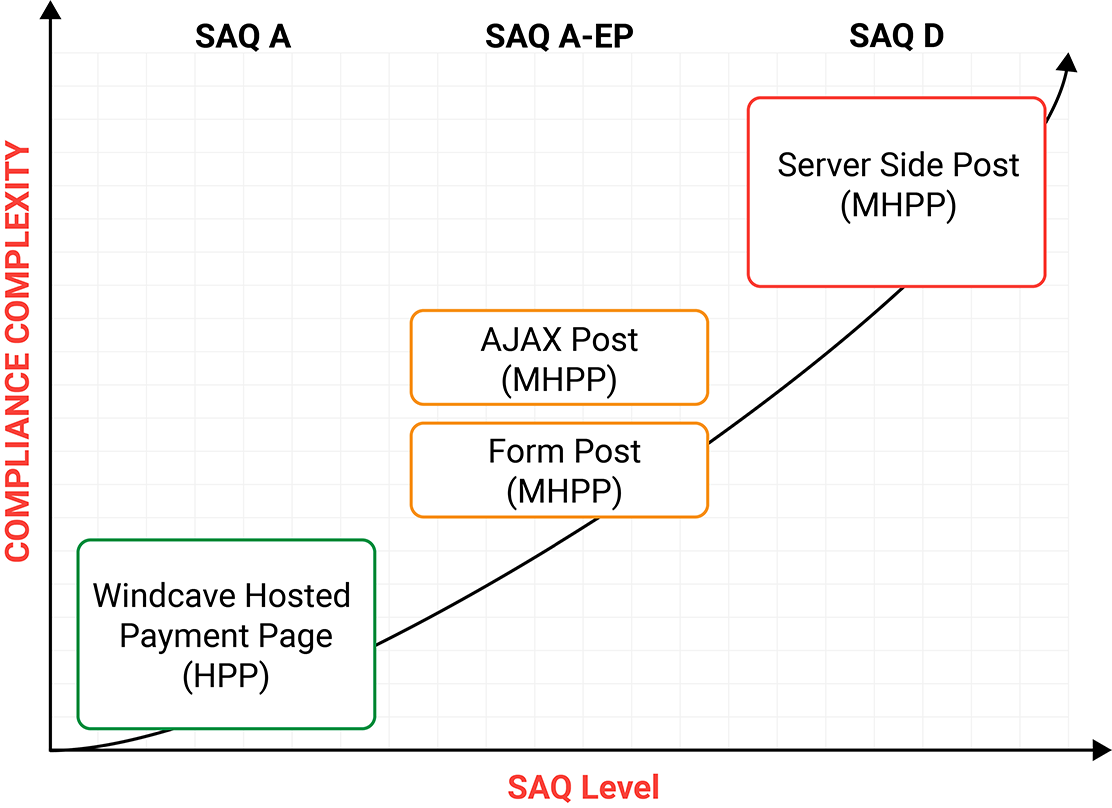

PCI SAQ

PCI SAQ (Self-Assessment Questionnaires) are validation tools intended to assist merchants and service providers to report the results of their PCI DSS self-assessment. For further information on SAQs please see the PCI security standards website.

Different functionality/integration methods are available that fit into the varying PCI SAQ levels, this section will help define what level PCI SAQ is needed to integrate to the REST API functionality.

Before choosing your desired integration method it is recommended that you speak with your primary merchant acquirer to confirm they allow the use of said integration method.

SAQ A

The Hosted Payment Page (HPP) provides merchants a PCI SAQ level A compliant solution by hosting the payment page/card capture within Windcave's secure network. At point of payment customers are redirected from the merchants website to the Windcave hosted payment page to enter their payment details securely, once entered the customer is redirected back to the merchants website with the payment result ensuring all payment details are capture securely within Windcave's secure payment environment.

For further details on integrating see the Hosted Payment Page section.

SAQ A-EP

The Merchant Hosted Payment Page (MHPP) utilizing client side form post or AJAX Post provides merchants a PCI SAQ level A-EP compliant solution while allowing a more native in appearance payment page. At point of payment sensitive payment details are posted directly to the Windcave secure environment from the customers browser using either a form post or AJAX post integration, during the payment process the customer remains on the merchants website however payment details are not allowed to pass through the merchant server.

For further details on integrating see the Windcave Form Post or AJAX Post section respectively.

SAQ D

The Merchant Hosted Payment Page (MHPP) utilizing server side post provides merchants a PCI SAQ level D compliant solution where merchants utilize a fully native payment page. At point of payment sensitive payment details are posted from the merchant server direct to Windcave, with card details being captured on the merchant server merchants are required to be PCI SAQ level D compliant. This integration method may not be supported by all acquirers, as such please consult with your primary merchant acquirer or Windcave Sales team before proceeding with a MHPP server side post integration.

For further details on integrating see the Server Side Post section.

Hosted Payment Page

Please note this section is documented in terms of purchase transactions, however Auth/Complete and Validate transaction types are also supported in these examples.

The Windcave Hosted Payment Page (HPP) is a payment page hosted on the Windcave secure payment network, merchants redirect their customers to the Windcave HPP to safely and securely enter their payment details before being redirected back to the merchant's website.

Commonly referred to as a hosted payment solution this integration method requires the least amount implementation effort and the lowest PCI compliance standard (PCI SAQ Level A) while still maintaining high levels of customisation and functionality.

HPP is regularly used in online booking, shopping carts, bill payments, and many more applications where secure payment processing is required.

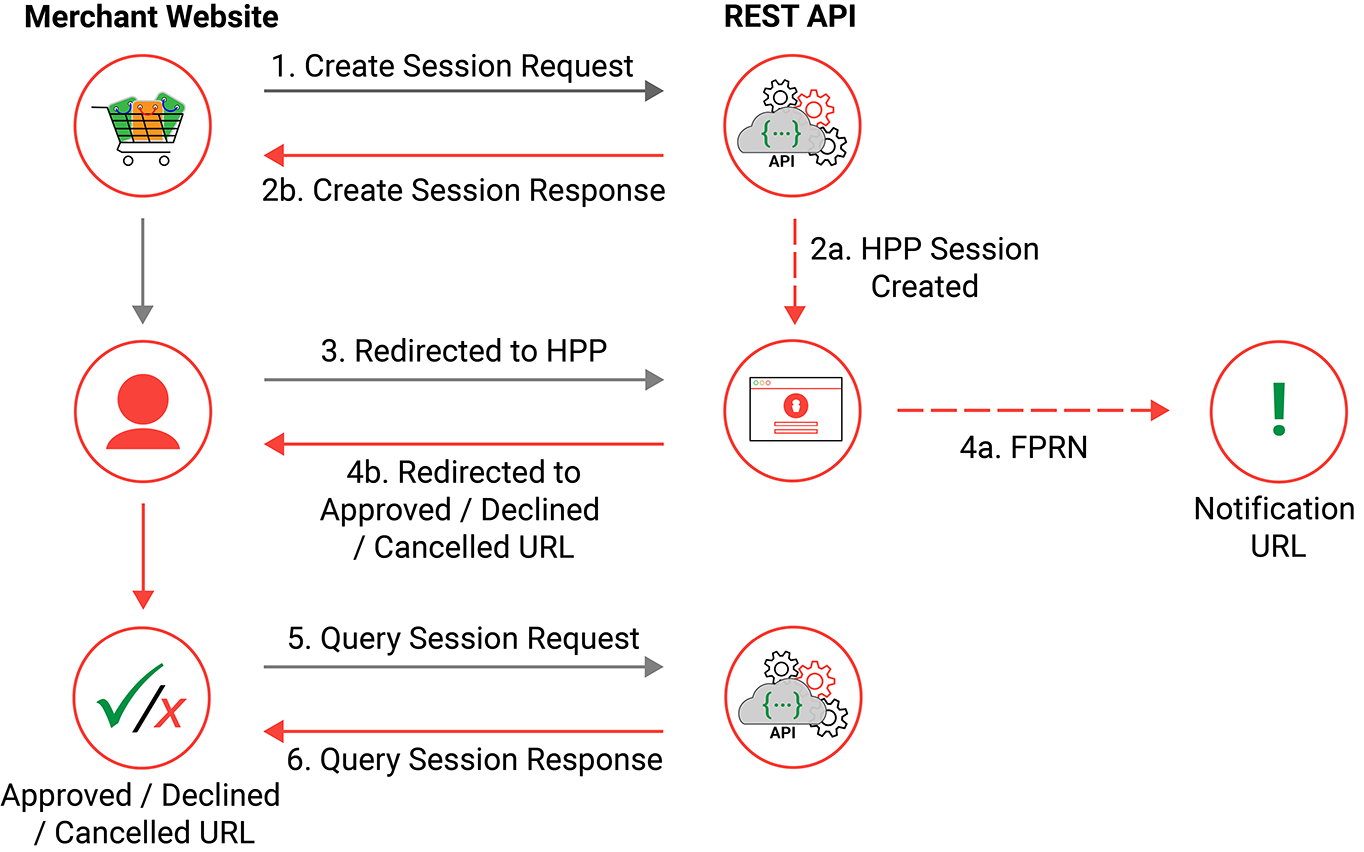

HPP Walkthrough

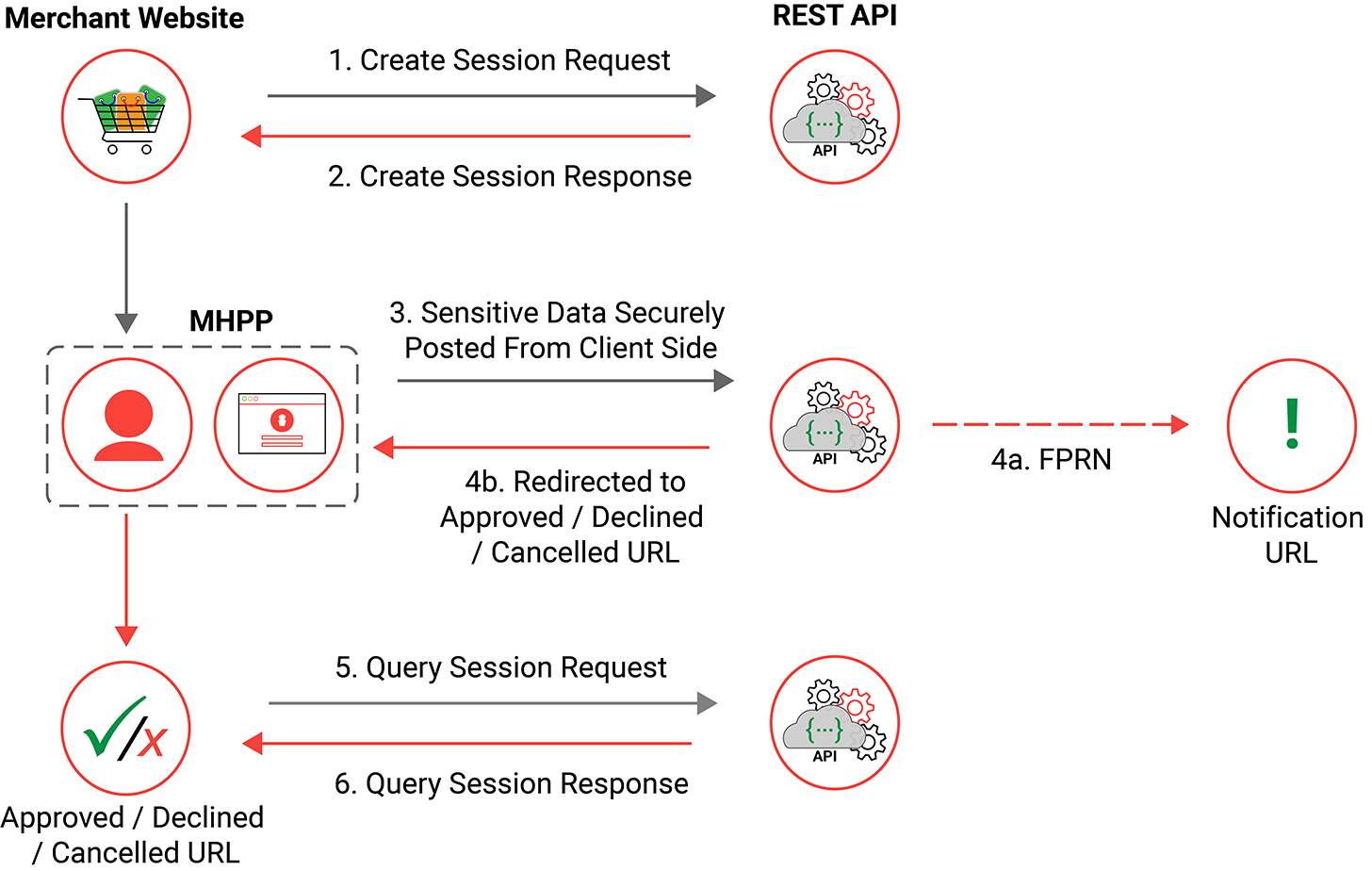

In order to provide each cardholder a secure HPP to enter their sensitive payment information a session is created in the Windcave host, this session handles all interactions between the user's browser and the Windcave secure host including any multi-stage payment interactions.

New sessions are created on request and triggered by the merchant web server sending a create session request, the newly created session will be given a session id which is used to reference the users payment while navigating between the merchant website and HPP.

The below flow diagram represents a high level HPP transaction flow from start to finish, more in-depth information for each stage of the flow is detailed in the next section.

Creating a Session

In order to provide the user with a payment page to enter their payment information the merchant webserver first needs to create a hosted payment page session.

This is achieved by the merchant webserver sending a create session request with the transaction specific information i.e. amount, currency, merchant reference and call back URL’s and merchant REST username and authentication. Below is an example of a simple create session request:

Endpoint:

POST https://sec.windcave.com/api/v1/sessions

Headers:

Content-Type:application/json

Authorization: Basic ABC123

Request Body:

{

"type": "purchase",

"amount": "1.00",

"currency": "NZD",

"merchantReference": "1234ABC",

"callbackUrls": {

"approved": "https://example.com/success",

"declined": "https://example.com/fail",

"cancelled": "https://example.com/cancel"

},

"notificationUrl": "https://example.com/txn_result?123"

}

By default new sessions have a 72 hour timeout period, alternatively merchants can control when the session expires by using the expires field in the create session request.

For more in-depth information on sending a create session request and processing the response please refer to the API reference documentation here.

Redirecting the User

After requesting the HPP session the merchant webserver next needs to be able to redirect the user to the newly created HPP to securely enter their payment details.

To achieve this the merchant webserver must read the URL link where “rel” is “hpp” from the create session response, and redirect the user to it. Below is an example of a simple create session response body and the “rel” as “hpp” containing the URI of the HPP:

HTTP Response Code:

202 Accepted

Response Body:

{

"id": "00001200030240010c9e7ceadd26a6d8",

"state": "init",

"links": [

{

"href": "https://sec.windcave.com/api/v1/sessions/00001200030240010c9e7ceadd26a6d8",

"rel": "self",

"method": "GET"

},

{

"href": "https://sec.windcave.com/pxmi3/EF4054F622D6C4C1B512FC9E81F547FA45A6ED23237FF3B236283493E38BF97630A40CC2F072621C2",

"rel": "hpp",

"method": "REDIRECT"

}

]

}

Also returned in the create session response is a URL that can be used in the Query Session request, this is read where the “rel” is “self” and is further detailed in the Obtaining the Transaction Result section.

For more in-depth information on sending a create session request and processing the response please refer to the API reference documentation here.

Entering Payment Information

After being redirected to the HPP the user will be presented with the available payment option(s) (a default option pre-selected based on the merchants REST user configuration) and an area to enter their payment information.

The user can review the payment details supplied by the merchant and if everything is correct enter their payment information and submit the transaction, alternatively if the details do not appear correct the user can cancel the payment.

Result Page

After submitting or cancelling the payment the user will be presented with a page displaying the result of their transaction along with transaction unique information for their reference.

Returning to the Merchant Website

After clicking next on the HPP result page the user is automatically redirected to the callback URLs specified in the create session request with a sessionId parameter in the URL.

Below is an example of the URL where the customer was redirected to the approved callback URL specified in the create session request.

https://example.com/success?sessionId=00001200030240010c9e7ceadd26a6d8

Obtaining the Transaction Result

The merchant webserver now needs to obtain the result of the transaction to update its internal order system etc.

Upon receiving a response to any of the callback URLs the merchant webserver should extract the sessionId value, then submit a query session request to obtain the transaction result. Below is an example of the query session HTTPS GET request:

Endpoint:

GET https://sec.windcave.com/api/v1/sessions/00001200030240010c9e7ceadd26a6d8

Headers:

Content-Type:application/json

Authorization: Basic ABC123

The response returned from the REST API contains the result of the specified session, this includes all transaction attempts made during the session. The merchant webserver must read the “authorised” attribute of the 0th transaction to determine the final result of the session, if true is returned the payment has been successfully authorized otherwise false will be returned to indicate payment has not been authorized.

Depending on individual merchant requirements additional details should be read and used to update the merchants internal order system. Below is a simple example of the query session response:

HTTP Response Code:

200 OK

Response Body:

{

"id": "00001200030240010c9e7ceadd26a6d8",

"state": "complete",

"type": "purchase",

"amount": "1.00",

"currency": "NZD",

"currencyNumeric": 554,

"merchantReference": "1234ABC",

"expires": "2020-05-11T03:06:07Z",

"storedCardIndicator": "single",

"callbackUrls": {

"approved": "https://example.com/success",

"declined": "https://example.com/fail",

"cancelled": "https://example.com/cancel"

},

"notificationUrl": "https://example.com/txn_result?123",

"storeCard": true,

"clientType": "internet",

"methods": ["card"],

"links": [

{

"href": "https://sec.windcave.com/api/v1/sessions/00001200030240010c9e7ceadd26a6d8",

"rel": "self",

"method": "GET"

},

{

"href": "https://sec.windcave.com/api/v1/transactions/0000000c01159507",

"rel": "transaction",

"method": "GET"

}

],

"transactions": [

{

"id": "0000000c01159507",

"username": "TestUser",

"authorised": true,

"reCo": "00",

"responseText": "APPROVED",

"authCode": "001543",

"type": "purchase",

"method": "card",

"localTimeZone": "NZT",

"dateTimeUtc": "2020-05-08T03:06:27Z",

"dateTimeLocal": "2020-05-08T15:06:27+12:00",

"settlementDate": "2020-05-08",

"amount": "1.00",

"balanceAmount": "0.00",

"currency": "NZD",

"currencyNumeric": 554,

"clientType": "internet",

"merchantReference": "1234ABC",

"card": {

"id": "0000120001291154",

"cardHolderName": "JOHN T DOE",

"cardNumber": "411111........11",

"dateExpiryMonth": "05",

"dateExpiryYear": "23",

"type": "visa"

},

"cvc2ResultCode": "U",

"storedCardIndicator": "single",

"notificationUrl": "https://example.com/txn_result?123",

"sessionId": "00001200030240010c9e7ceadd26a6d8",

"isSurcharge": false,

"liabilityIndicator": "standard",

"links": [

{

"href": "https://sec.windcave.com/api/v1/transactions/0000000c01159507",

"rel": "self",

"method": "GET"

},

{

"href": "https://sec.windcave.com/api/v1/sessions/00001200030240010c9e7ceadd26a6d8",

"rel": "session",

"method": "GET"

},

{

"href": "https://sec.windcave.com/api/v1/transactions",

"rel": "refund",

"method": "POST"

}

]

}

]

}

For more in-depth information on sending a query session request and processing the response please refer to the API reference documentation here.

HPP & 3D Secure

3D Secure allows merchants additional protection against fraudulent transactions by implementing further authentication for higher risk transactions and shifting liability from merchants to issuers.

The HPP solution supports 3D Secure, where supported by the acquirer. For further details about functionality and features, please see 3D Secure.

HPP 3D Secure Implementation

Implementing 3D Secure for HPP solutions requires your REST username be enabled for 3D Secure functionality. If you are unsure or would like to enquire about adding 3D Secure to your REST account, please contact us.

If 3D Secure has been enabled on your REST user, you simply need to follow the HPP Walkthrough process to initiate a payment. All 3D Secure actions will be handled with the cardholder on the HPP.

For further information on responses, please refer to 3D Secure.

To help increase chances of transactions meeting the frictionless flow merchants' criteria can include additional information about the payment in the Create Session request, for further information please refer to 3D Secure Optional Fields.

HPP & FPRN

Fail Proof Result Notification (FPRN) helps ensure the merchant web application receives the payment outcome in scenarios such as; the cardholder not returning to the merchant website due to browser being closed prior or the merchant web server being temporarily unavailable just prior to the transaction being processed.

The HPP solution supports FPRN and it is enabled by default for any new account setups, for further information please see Fail Proof Result Notification.

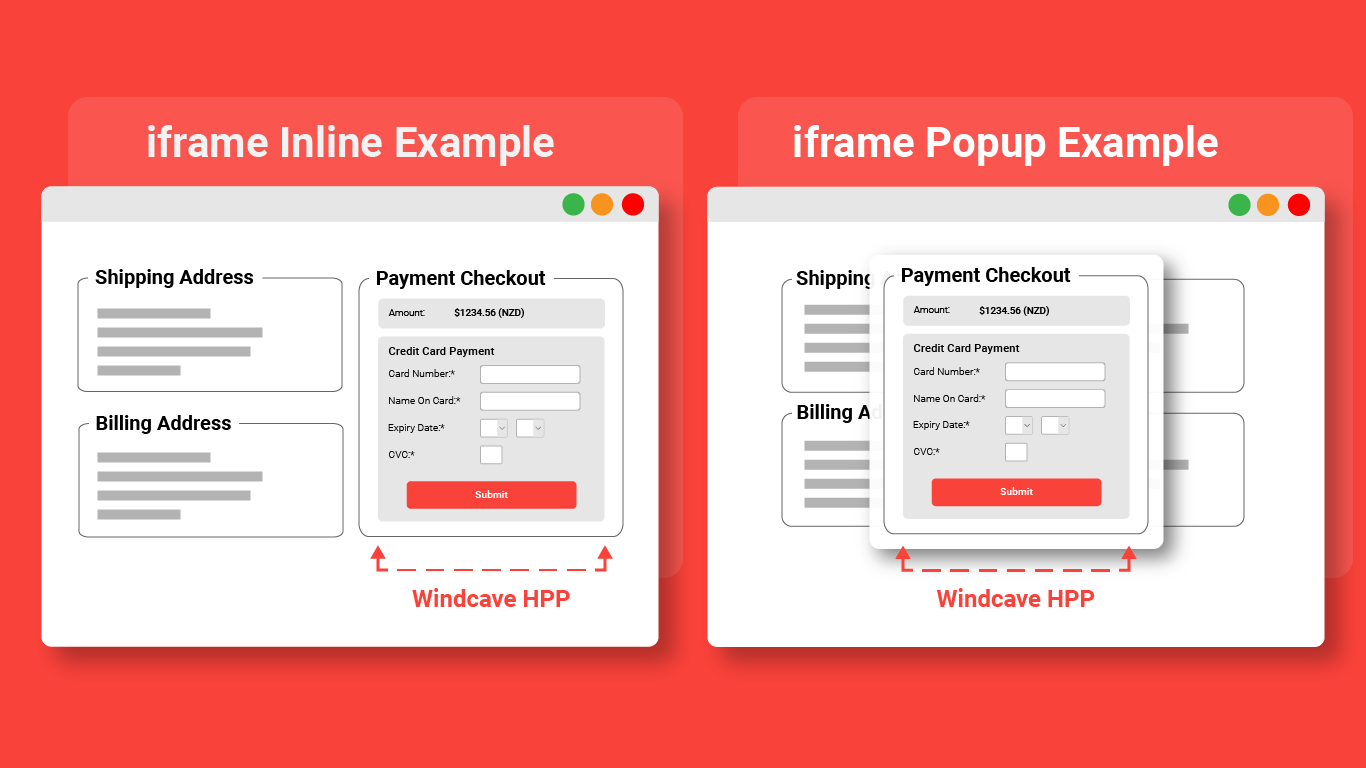

iframe Embedded HPP

Using an iframe allows the merchant website to embed another webpage within their page, embedding the Hosted Payment Page into an iframe provides a sense of comfort and familiarity to end users who may be uneasy about being redirected away from the merchant website.

The below image shows examples of iframe implementations:

Implementing iframes

As explained in the HPP Walkthrough process merchants should redirect to the URL returned in the create session response where "rel" is "hpp", for iframe implementations the merchant should instead load the same URL into a responsive iframe on their checkout payment page; this way the HPP is embedded within their own webpage.

Merchants can use the below sample code to create a responsive iframe in their webpage, setting the value for the src attribute to the URL returned in the create session response where "rel" is "hpp":

<iframe class=”responsive-iframe” src=”https://sec.windcave.com/pxmi3/EF4054F622D6C4C1B512FC9E81F547FA45A6ED23237FF3B236283493E38BF97630A40CC2F072621C2” scrolling=”auto” frameborder=”0”></iframe>

Breaking out of an iframe

After the payment process has been completed, the HPP will be redirected back to the merchant's website per the callbackUrls nominated in the create session request. The merchant webpage should expect and handle this scenario appropriately by breaking out of the iframe once the payment result has been received.

Below is a JavaScript code snippet that can be set on the merchant callback webpage to break out of an iframe, this will result in the top page being redirected the URL of the iframe which should be the callbackUrl nominated in the create session request:

if (top.location != location) {

top.location.href = document.location.href;

}

iframe css

The CSS example below demonstrates how a merchant webpage can control the size of the iframe based on the user's screen size, this is achieved by utilizing media queries to create breakpoints for different screen sizes:

/* Control the height of the iframe */

.responsive-iframe {

height: insert your value;

width:100%;

}

/* Small devices (tablets, 768px and up) */

@media (min-width: 768px) {

.responsive-iframe {

height: insert your value;

}

}

/* Medium devices (desktops, 992px and up) */

@media (min-width: 992px) {

.responsive-iframe{

height: insert your value;

}

}

/* Large devices (large desktops, 1200px and up) */

@media (min-width: 1200px) {

.responsive-iframe {

height: insert your value;

}

}

Paylink via API

Paylink allows merchants to request Windcave send a Hosted Payment Page (HPP) link directly to the user via email or SMS.

With support for 3D Secure the HPP provides merchants additional protection against chargebacks instead of processing MOTO (Mail Order Telephone Order) payments, reducing the risks and cost of accepting credit card payments.

Implementing Paylink via API

Implementing Paylink via API requires merchants to include the sessionDeliveryMethod field in the Create Session request; this indicates how the HPP link should be delivered to the user and can be set to either "email" or "sms".

Additionally merchants must include the customer object and either the email or phoneNumber field depending on the sessionDeliveryMethod used, these fields should be populated with the email address or phone number you would like the HPP link to be sent to.

Below is an example of a Create Session request where sessionDeliveryMethod is set to email:

Endpoint:

POST https://sec.windcave.com/api/v1/sessions

Headers:

Content-Type:application/json

Authorization: Basic ABC123

Request Body:

{

"amount": "1.00",

"currency": "NZD",

"merchantReference": "1234ABC",

"type": "purchase",

"sessionDeliveryMethod": "email",

"callbackUrls": {

"approved": "https://example.com/success",

"declined": "https://example.com/fail",

"cancelled": "https://example.com/cancel"

},

"notificationUrl": "https://example.com/txn_result?123",

"customer":{

"email": "[email protected]"

}

}

Below is an example of a Create Session request where sessionDeliveryMethod is set to sms:

Endpoint:

POST https://sec.windcave.com/api/v1/sessions

Headers:

Content-Type:application/json

Authorization: Basic ABC123

Request Body:

{

"type": "purchase",

"amount": "1.00",

"currency": "NZD",

"merchantReference": "1234ABC",

"sessionDeliveryMethod": "sms",

"callbackUrls": {

"approved": "https://example.com/success",

"declined": "https://example.com/fail",

"cancelled": "https://example.com/cancel"

},

"notificationUrl": "https://example.com/txn_result?123",

"customer":{

"phoneNumber": "+64123456789"

}

}

Upon receiving a successful Create Session response the merchant web application should follow the standard HPP Walkthrough procedure with the exception that the user does not need to be redirected to the HPP page as this has been sent to the requested email or phone number.

Paylink Customization

Please see the Paylink Customization page for more information about how you can customize your Paylink user experience.

Drop-In

The Windcave Drop-In solution is a client-side JS library that allows merchants to construct the UI for accepting payments at their checkout page while maintaining PCI compliance for the interface.

This is a great solution for merchants looking to implement a simple pre-built payment UI into their checkout process.

For further information please refer to the Drop-In Integration Guide.

Hosted Fields

The Windcave Hosted Fields solution is a client-side JavaScript (JS) library which utilizes the AJAX POST to allow merchants to customize their checkout page's payment UI while keeping PCI compliance.

For further information please refer to the Hosted Fields Integration Guide.

Form Post

Please note this section is documented in terms of purchase transactions, however Auth/Complete and Validate transaction types are also supported in these examples.

The Merchant Hosted Payment Page (MHPP) form post integration utilizes a client side HTML form, the secure card data is securely posted from the cardholder's browser directly to the Windcave Host. With the MHPP form being hosted on the merchant's website it provides a merchant controlled UI experience for users.

This method may be preferred for merchants as there is no redirection for their customer, meaning they do not need to leave the merchant website to enter their payment details. This however will increase the PCI SAQ scope (SAQ A-EP) and this integration method is not supported by all acquirers, it is strongly recommended that you discuss with your chosen acquirer before proceeding with this integration method.

Form Post Walkthrough

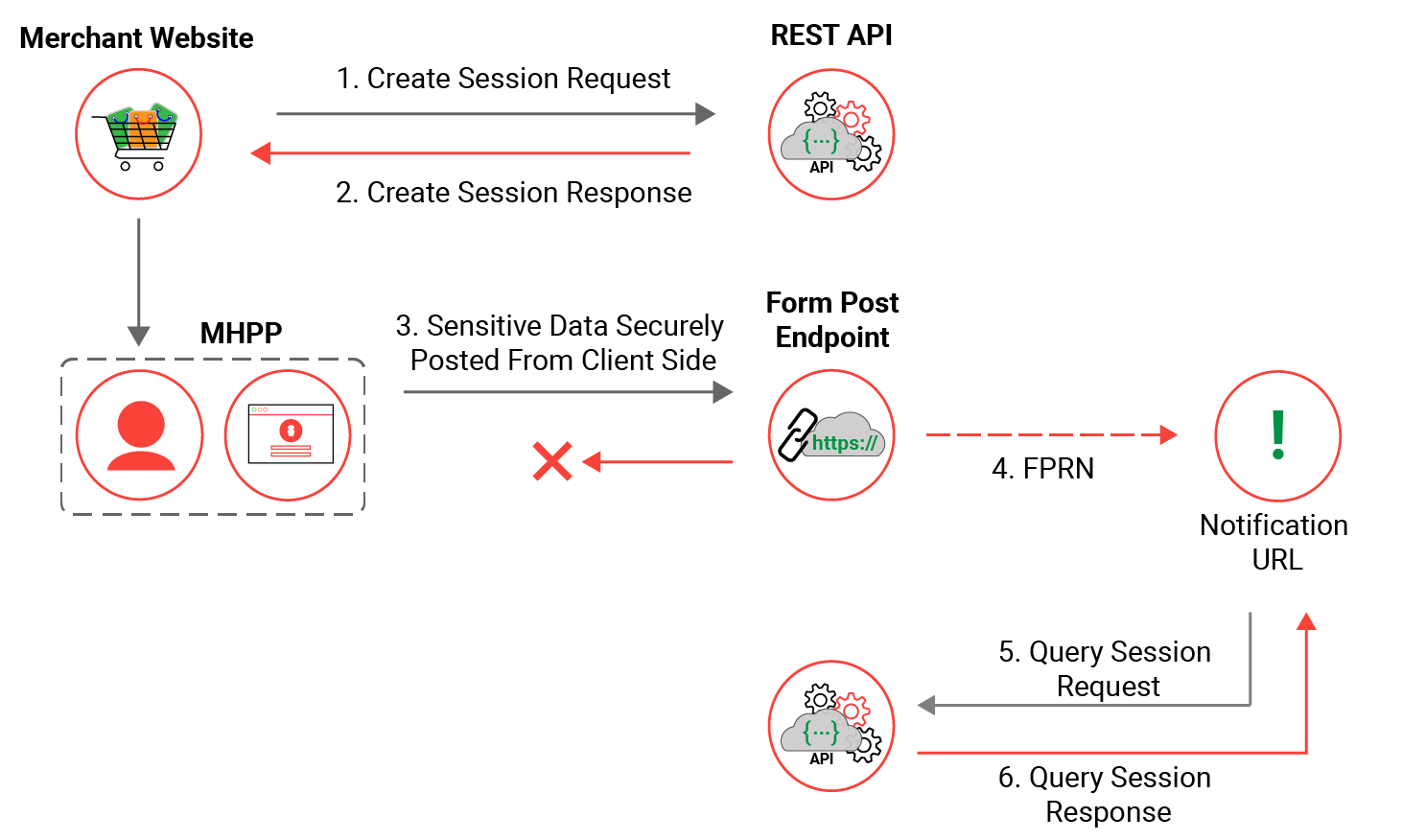

For merchants to be able to securely post their users sensitive payment information from the client side form directly to Windcave; a session is created in the Windcave host for each payment.

New sessions are created on request and triggered by the merchant web server sending a create session request, the newly created session will be given a session id which is used to reference the users payment.

The below flow diagram represents a high level Form Post transaction flow from start to finish, more in-depth information for each stage of the flow is detailed in the next section.

Creating a Session

In order to be able to securely post the users sensitive payment information the merchant webserver first needs to create a form post session.

This is achieved by the merchant webserver sending a create session request with the transaction specific information i.e. amount, currency, merchant reference and call back URL’s and merchant REST username and authentication. Below is an example of a simple create session request:

Endpoint:

POST https://sec.windcave.com/api/v1/sessions

Headers:

Content-Type:application/json

Authorization: Basic ABC123

Request Body:

{

"type": "purchase",

"amount": "1.00",

"currency": "NZD",

"merchantReference": "1234ABC",

"language": "en",

"methods": ["card"],

"callbackUrls": {

"approved": "https://example.com/success",

"declined": "https://example.com/fail",

"cancelled": "https://example.com/cancel"

},

"notificationUrl": "https://example.com/txn_result?123"

}

By default new sessions have a 72 hour timeout period, alternatively merchants can control when the session expires by using the expires field in the Create Session request.

For more in-depth information on sending a create session request and processing the response please refer to the API reference documentation here.

Extracting the URL

After creating a session the merchant webserver next needs a URL that the client side form can use to post the users sensitive payment information to process payment.

To achieve this the merchant webserver must read the URL link where “rel” is “submitCard” from the Create Session response. Below is an example of a simple create session response body and the “rel” as “submitCard” containing the URL :

HTTP Response Code:

202 Accepted

Response Body:

{

"id": "00001200030240010c9e7ceadd26a6d8",

"state": "init",

"links": [

{

"href": "https://sec.windcave.com/api/v1/sessions/00001200030240010c9e7ceadd26a6d8",

"rel": "self",

"method": "GET"

},

{

"href": "https://sec.windcave.com/pxmi3/E494B52F483B328E3B259646A63FAF64AAC05E252FF87EB6A623D2C5817CA0B3C75B8B9176333D6EA",

"rel": "submitCard",

"method": "FORM_POST"

}

]

}

Also returned in the create session response is a URL that can be used in the query session request, this is read where the “rel” is “self” and is further detailed in the Obtaining the Transaction Result section.

For more in-depth information on sending a create session request and processing the response please refer to the API reference documentation here.

Rendering the Form

After requesting the MHPP session the merchant webserver next needs to be able to render the client side Merchant Hosted HTML form where customers can securely enter their payment details, this form must contain the below minimum required template of HTML form tag and input tag with the same name attribute:

<form method="post" enctype="multipart/form-data" action=" INSERT HREF VALUE HERE ">

<input type="text" name="CardNumber" minlength="14" maxlength="16" />

<input type="text" name="CardHolderName" maxlength="64"/>

<input type="text" name="ExpiryMonth" minlength="2" maxlength="2" />

<input type="text" name="ExpiryYear" minlength="2" maxlength="2" />

<input type="text" name="Cvc2" minlength="3" maxlength="4" />

<input type="submit" value="Submit" />

</form>

Note: The merchant website should include client side validation on each card form field, especially validating CardNumber with a standard Luhn Check using standard JavaScript. Also including a basic future expiry date and CVC digits length check.

Entering Payment Information

The merchant webserver should now be presenting a HTML client side form to the user to enter their payment details into, the user will check all details i.e. amount and reference are correct before entering their sensitive payment information.

As this is a client side form the merchant webserver is not to have access to any of the data populated in these fields.

Post Form Data

After entering all their payment details the user clicks the submit button on the client side form, this should trigger the client side to securely post the sensitive payment data to the Windcave host directly using the HREF value entered into the HTML form.

Once received the Windcave host processes the transaction via the merchant's acquirer to the payment schemes.

Redirecting Customer to Callback URL

After completing all processing of the transaction the Windcave host will redirect the user to the Approved/Declined/Cancelled callback URL nominated in the create session request by the merchant webserver.

Appended to the Approved/Declined/Cancelled callback URL will be the session id, here the merchant webserver will capture this session id before proceeding to the next stage.

Below is an example of the URL where the customer was redirected to the approved callback URL specified in the create session request.

https://example.com/success?sessionId=00001200030240010c9e7ceadd26a6d8

Obtaining the Transaction Result

The merchant webserver now needs to obtain the result of the transaction to update its internal order system etc.

Upon receiving a response to any of the callback URLs the merchant webserver should extract the sessionId value, then submit a query session request to obtain the transaction result. Below is an example of the query session HTTPS GET request:

Endpoint:

GET https://sec.windcave.com/api/v1/sessions/00001200030240010c9e7ceadd26a6d8

Headers:

Content-Type:application/json

Authorization: Basic ABC123

The response returned from the REST API contains the result of the specified session, this includes all transaction attempts made during the session. The merchant webserver must read the “authorised” attribute of the 0th transaction to determine the final result of the session, if true is returned the payment has been successfully authorized otherwise false will be returned to indicate payment has not been authorized.

Depending on individual merchant requirements additional details should be read and used to update the merchants internal order system. Below is a simple example of the query session response:

HTTP Response Code:

200 OK

Response Body:

{

"id": "00001200030240010c9e7ceadd26a6d8",

"state": "complete",

"type": "purchase",

"amount": "1.00",

"currency": "NZD",

"currencyNumeric": 554,

"merchantReference": "1234ABC",

"expires": "2020-05-11T03:06:07Z",

"storedCardIndicator": "single",

"callbackUrls": {

"approved": "https://example.com/success",

"declined": "https://example.com/fail",

"cancelled": "https://example.com/cancel"

},

"notificationUrl": "https://example.com/txn_result?123",

"storeCard": true,

"clientType": "internet",

"methods": ["card"],

"links": [

{

"href": "https://sec.windcave.com/api/v1/sessions/00001200030240010c9e7ceadd26a6d8",

"rel": "self",

"method": "GET"

},

{

"href": "https://sec.windcave.com/api/v1/transactions/0000000c01159507",

"rel": "transaction",

"method": "GET"

}

],

"transactions": [

{

"id": "0000000c01159507",

"username": "TestUser",

"authorised": true,

"reCo": "00",

"responseText": "APPROVED",

"authCode": "001543",

"type": "purchase",

"method": "card",

"localTimeZone": "NZT",

"dateTimeUtc": "2020-05-08T03:06:27Z",

"dateTimeLocal": "2020-05-08T15:06:27+12:00",

"settlementDate": "2020-05-08",

"amount": "1.00",

"balanceAmount": "0.00",

"currency": "NZD",

"currencyNumeric": 554,

"clientType": "internet",

"merchantReference": "1234ABC",

"card": {

"id": "0000120001291154",

"cardHolderName": "JOHN T DOE",

"cardNumber": "411111........11",

"dateExpiryMonth": "05",

"dateExpiryYear": "23",

"type": "visa"

},

"cvc2ResultCode": "U",

"storedCardIndicator": "single",

"notificationUrl": "https://example.com/txn_result?123",

"sessionId": "00001200030240010c9e7ceadd26a6d8",

"isSurcharge": false,

"liabilityIndicator": "standard",

"links": [

{

"href": "https://sec.windcave.com/api/v1/transactions/0000000c01159507",

"rel": "self",

"method": "GET"

},

{

"href": "https://sec.windcave.com/api/v1/sessions/00001200030240010c9e7ceadd26a6d8",

"rel": "session",

"method": "GET"

},

{

"href": "https://sec.windcave.com/api/v1/transactions",

"rel": "refund",

"method": "POST"

}

]

}

]

}

For more in-depth information on sending a query session request and processing the response please refer to the API reference documentation here.

Form Post & 3D Secure

3D Secure allows merchants additional protection against fraudulent transactions by implementing further authentication for higher risk transactions and shifting liability from merchants to issuers.

The Form Post solution supports 3D Secure, where supported by the acquirer. For further details about functionality and features, please see 3D Secure.

Form Post 3D Secure Implementation

Implementing 3D Secure for Form post solutions requires your REST username be enabled for 3D Secure functionality. if you are unsure or would like to enquire about adding 3D Secure to your REST account please contact us.

If 3D Secure has been enabled on your REST user, you simply need to follow the Form Post Walkthrough process to initiate payment. All 3D Secure required actions will be handled by the Windcave host with the cardholder once the client-side form has been submitted.

For further information on the responses, please see 3D Secure.

To help increase the chances of transactions meeting the frictionless flow criteria merchants can include additional information about the payment in the Create Session request. For more information, please refer to 3D Secure Optional Fields.

Form Post & FPRN

Fail Proof Result Notification (FPRN) helps ensure the merchant web application receives the payment outcome in scenarios such as; the cardholder not returning to the merchant website due to browser being closed prior or the merchant webserver being temporarily unavailable just prior to the transaction being processed.

The Form Post solution supports FPRN and it is enabled by default for any new account setups, for further information please see Fail Proof Result Notification.

AJAX Post

Please note this section is documented in terms of purchase transactions, however Auth/Complete and Validate transaction types are also supported in these examples.

The Merchant Hosted Payment Page (MHPP) AJAX post integration utilizes a client-side form, the secure card data is securely posted from the cardholder's browser directly to the Windcave Host. With the MHPP form being hosted on the merchant's website it allows merchants to offer a more native payment page experience.

AJAX or Asynchronous JavaScript and XML involves the loading of data in the background and displaying it on the webpage without reloading the whole page, for more information about AJAX you can refer to https://www.w3schools.com/jquery/jquery_ajax_intro.asp.

This method may be preferred for merchants as there is no redirection for their customer, meaning they do not need to leave the merchant website to enter their payment details. This however will increase the PCI SAQ scope (SAQ A-EP) and this integration method is not supported by all acquirers, it is strongly recommended that you discuss with your chosen acquirer before proceeding with this integration method.

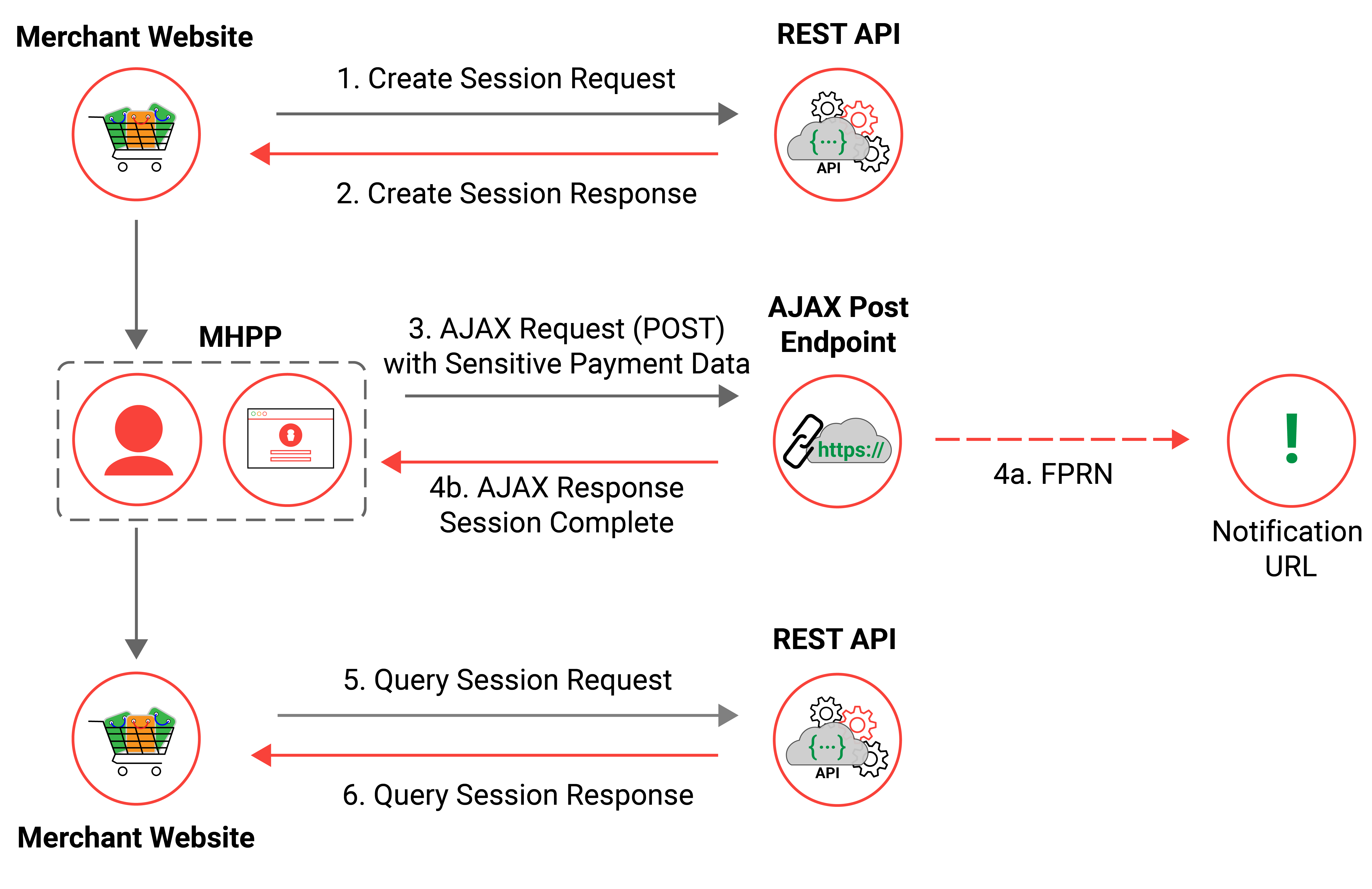

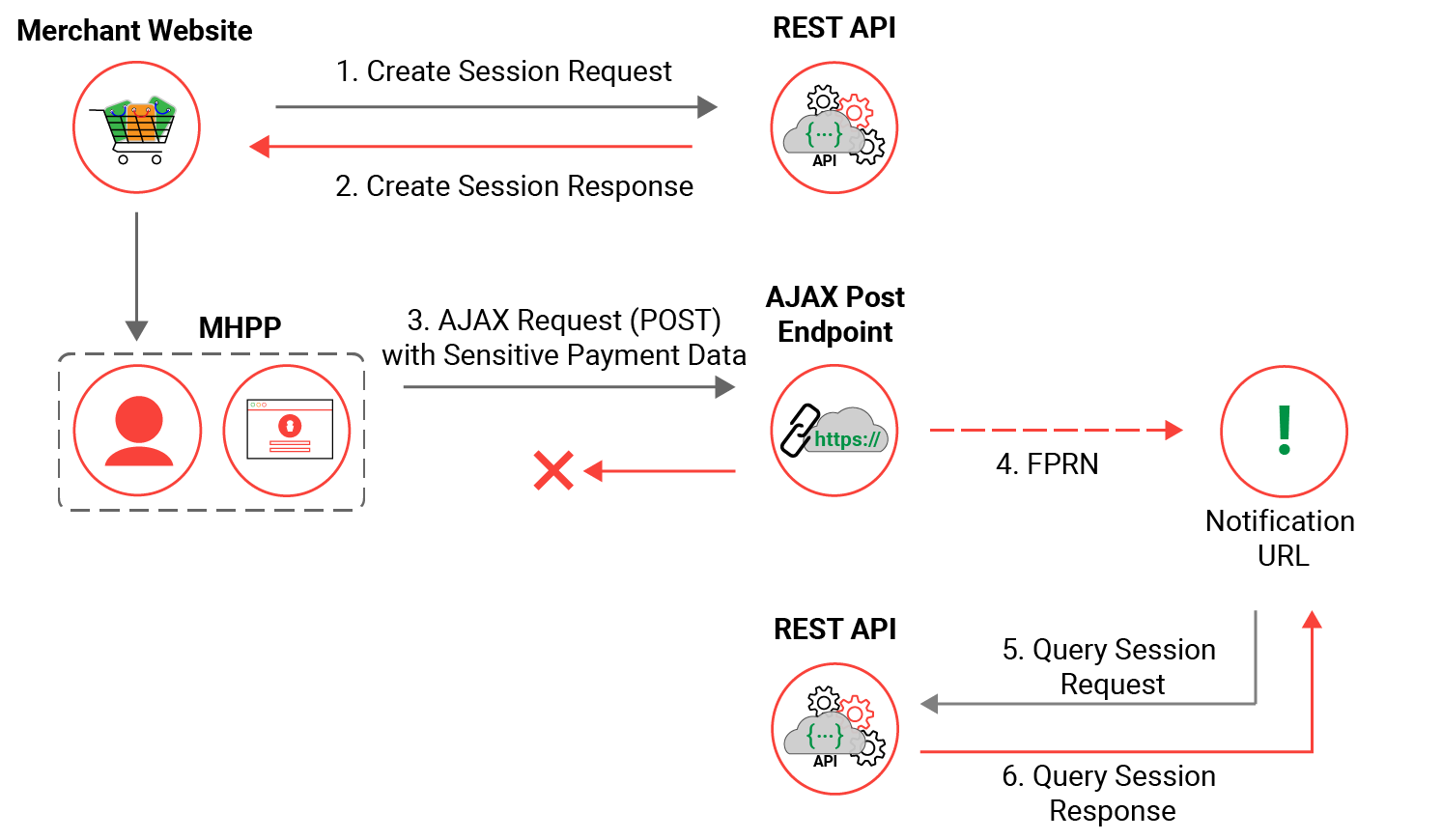

AJAX Post Walkthrough

The below flow diagram represents a high-level AJAX Post transaction flow from start to finish, more in-depth information for each stage of the flow is detailed in the next section.

Creating a Session

In order to be able to securely post the users sensitive payment information the merchant web server first needs to create an AJAX POST session; this is achieved by the merchant web server sending a create session request.

Below is an example of a simple create session request:

Endpoint:

POST https://sec.windcave.com/api/v1/sessions

Headers:

Content-Type:application/json

Authorization: Basic ABC123

Request Body:

{

"type": "purchase",

"amount": "1.00",

"currency": "NZD",

"merchantReference": "1234ABC",

"language": "en",

"methods": ["card"],

"callbackUrls": {

"approved": "https://example.com/success",

"declined": "https://example.com/fail",

"cancelled": "https://example.com/cancel"

},

"notificationUrl": "https://example.com/txn_result?123"

}

For more in-depth information on sending a create session request and processing the response please refer to the API reference documentation.

Handling the Session Response

Upon receiving the create session response the merchant web server must extract the URL link where "rel" is "ajaxSubmitCard", this URL must be stored for use in the AJAX POST action when submitting payment details.

Additionally, the merchant web server must extract the unique session id from the id field in the response, this should be retained and associated with your own cart session; merchants must ensure the session Id referenced is always the Id expected for the current cart session.

Below is an example of a simple create session response:

HTTP Response Code:

202 Accepted

Response Body:

{

"id": "00001200030240010c9e7ceadd26a6d8",

"state": "init",

"links": [

{

"href": "https://sec.windcave.com/api/v1/sessions/00001200030240010c9e7ceadd26a6d8",

"rel": "self",

"method": "GET"

},

{

"href": "https://sec.windcave.com/mh/E1D1D31611F02E8BC13676A3B745A14FC850CB6CE344120667D8A6C095D1A395F8D05253B14C4C4EC",

"rel": "ajaxSubmitCard",

"method": "AJAX_POST"

}

]

}

For more in-depth information on processing the response please refer to the API reference documentation.

Rendering the MHPP

A MHPP client-side payment form must be rendered to allow the cardholder to enter their payments details, how the MHPP is rendered is the responsibility of the merchant however the below fields must be included at a minimum:

- cardholderName

- cardNumber

- dateExpiryMonth

- dateExpiryYear

- cvc2

It is recommended that client-side validation such as performing a Luhn check to validate the cardNumber field, basic future expiry date check and CVC digit length check be performed before submitting the data to the Windcave host.

AJAX Request (POST)

Upon MHPP submission trigger an AJAX POST request is sent to the AJAX Post endpoint (ajaxSubmitCard URL), the body of the request is in JSON format with a card object containing the payment details entered into the MHPP form.

Below is an example of the AJAX POST request:

Endpoint:

POST https://sec.windcave.com/mh/E1D1D31611F02E8BC13676A3B745A14FC850CB6CE344120667D8A6C095D1A395F8D05253B14C4C4EC

Headers:

Content-Type:application/json

Request Body:

{

"card": {

"cardHolderName": "JOHN T DOE",

"cardNumber": "4111111111111111",

"dateExpiryMonth": "01",

"dateExpiryYear": "18",

"cvc2": "111"

}

}

Once received the Windcave host processes the transaction via the merchant's acquirer to the payment schemes.

Handling the AJAX Response

Upon receiving a response, the merchants AJAX must ensure the response is for the current cart session, this is done by comparing the id value returned to that stored from the create session response.

Please note if the appropriate callbackUrls were populated in the create session request this will also be returned in the response, merchants can choose to redirect the page to the link where "rel" is "done" however this is optional.

Below is an example of an AJAX Response:

HTTP Response Code:

200 OK

Response Body:

{

"id": "00001200036244160cd3eed722903bc5",

"links": [

{

"href": "https://example.com/success?sessionId=00001200036244160cd3eed722903bc5",

"rel": "done",

"method": "REDIRECT"

}

]

}

Obtaining the Transaction Result

To obtain the result of the transaction the merchant web server must submit a query session request using the id stored from the create session response.

Below is an example of a query session request:

Endpoint:

GET https://sec.windcave.com/api/v1/sessions/00001200030240010c9e7ceadd26a6d8

Headers:

Content-Type:application/json

Authorization: Basic ABC123

The response to the query session request includes all transaction attempts during the specified session, the merchant web server must read the “authorised” attribute of the 0th transaction to determine the final result of the session; if true is returned the payment has been successfully authorized otherwise false will be returned and indicates the payment has not been authorized.

Optionally merchants may read and use additional details in the response to update their internal order system.

Below is a simple example of the query session response:

HTTP Response Code:

200 OK

Response Body:

{

"id": "00001200030240010c9e7ceadd26a6d8",

"state": "complete",

"type": "purchase",

"amount": "1.00",

"currency": "NZD",

"currencyNumeric": 554,

"merchantReference": "1234ABC",

"expires": "2020-05-11T03:06:07Z",

"storedCardIndicator": "single",

"callbackUrls": {

"approved": "https://example.com/success",

"declined": "https://example.com/fail",

"cancelled": "https://example.com/cancel"

},

"notificationUrl": "https://example.com/txn_result?123",

"storeCard": true,

"clientType": "internet",

"methods": ["card"],

"links": [

{

"href": "https://sec.windcave.com/api/v1/sessions/00001200030240010c9e7ceadd26a6d8",

"rel": "self",

"method": "GET"

},

{

"href": "https://sec.windcave.com/api/v1/transactions/0000000c01159507",

"rel": "transaction",

"method": "GET"

}

],

"transactions": [

{

"id": "0000000c01159507",

"username": "TestUser",

"authorised": true,

"reCo": "00",

"responseText": "APPROVED",

"authCode": "001543",

"type": "purchase",

"method": "card",

"localTimeZone": "NZT",

"dateTimeUtc": "2020-05-08T03:06:27Z",

"dateTimeLocal": "2020-05-08T15:06:27+12:00",

"settlementDate": "2020-05-08",

"amount": "1.00",

"balanceAmount": "0.00",

"currency": "NZD",

"currencyNumeric": 554,

"clientType": "internet",

"merchantReference": "1234ABC",

"card": {

"id": "0000120001291154",

"cardHolderName": "JOHN T DOE",

"cardNumber": "411111........11",

"dateExpiryMonth": "01",

"dateExpiryYear": "23",

"type": "visa"

},

"cvc2ResultCode": "U",

"storedCardIndicator": "single",

"notificationUrl": "https://example.com/txn_result?123",

"sessionId": "00001200030240010c9e7ceadd26a6d8",

"liabilityIndicator": "standard",

"links": [

{

"href": "https://sec.windcave.com/api/v1/transactions/0000000c01159507",

"rel": "self",

"method": "GET"

},

{

"href": "https://sec.windcave.com/api/v1/sessions/00001200030240010c9e7ceadd26a6d8",

"rel": "session",

"method": "GET"

},

{

"href": "https://sec.windcave.com/api/v1/transactions",

"rel": "refund",

"method": "POST"

}

]

}

]

}

For more in-depth information on sending a query session request and processing the response please refer to the API reference documentation.

AJAX Post & 3D Secure

3D Secure allows merchants additional protection against fraudulent transactions by implementing further authentication for higher risk transactions and shifting the liability from merchants to issuers.

The AJAX Post solution supports 3D Secure, where supported by the acquirer, for further details about functionality and features, please see 3D Secure.

AJAX Post 3D Secure Implementation

Implementing 3D Secure for AJAX Post solutions requires your REST username be enabled for 3D Secure functionality, if you are unsure or would like to enquire about adding 3D Secure to your REST account please contact us.

If 3D Secure has been enabled on your REST user you simply need to follow the AJAX Post Walkthrough process to initiate payment, any 3D Secure required actions will be returned once the client-side form has been posted.

If 3D Secure is required the merchant webserver will receive the below response with “rel” as “3DSecure”, the merchant webserver must extract and redirect the cardholder to the URL provided in the response:

Response Code:

200 OK

Response Body:

{

"id": "00001200051135660cfeb60f8b57bf6d",

"links": [

{

"href": "https://sec.windcave.com/pxmi3/F1380F851DF6FF971A55B79DFCCCD4ECE5EB69B0ACEE43397D5EB2374E9E5AABB211EC1E2F3D0BF7C6ABC66E806D7CFBF",

"rel": "3DSecure",

"method": "REDIRECT"

}

],

}

Once redirected the Windcave hosted 3D Secure URL will handle any 3D Secure actions with the cardholder, for further information please refer to Browser-Based Authentication.

Once all 3D secure requirements have been completed, the user is automatically redirected to the callback URLs specified in the Create Session request with a sessionId parameter in the URL.

Below is an example of the URL where the customer was redirected to the approved callback URL specified in the Create Session request.

https://example.com/success?sessionId=00001200030240010c9e7ceadd26a6d8

To help increase chances of transactions meeting the frictionless flow criteria merchants can include additional information about the payment in the Create Session request, for further information and responses please refer to 3D Secure Optional Fields.

AJAX Post & FPRN

Fail Proof Result Notification (FPRN) helps ensure the merchant web application receives the payment outcome in scenarios such as; the cardholder prematurely closes the merchant website or the merchant webserver being temporarily unavailable just prior to the transaction being processed.

The AJAX Post solution supports FPRN and it is enabled by default for any new account setups, for further information please see Fail Proof Result Notification.

Server Side Post

Please note this section is documented in terms of purchase transactions, however Auth/Complete and Validate transaction types are also supported in these examples.

The Merchant Hosted Payment Page (MHPP) server side post integration utilizes a server side form, the secure card data is posted from the merchant webserver directly to the Windcave host. As the MHPP is hosted on the merchant's website it allows merchants to offer a fully native payment page experience.

This method may be preferred for some merchants as the fully native payment page provides further control and capture of full card details. This however will increase the PCI SAQ scope (SAQ D) and this integration method is not supported by all acquirers, it is strongly recommended that you discuss with your chosen acquirer before proceeding with this integration method.

Please note merchants may be requested to provide their PCI-DSS Attestation of Compliance (AOC) to Windcave before proceeding with integrating to this method, a Non-Disclosure Agreement (NDA) may be put in place prior to sharing the PCI-DSS AOC.

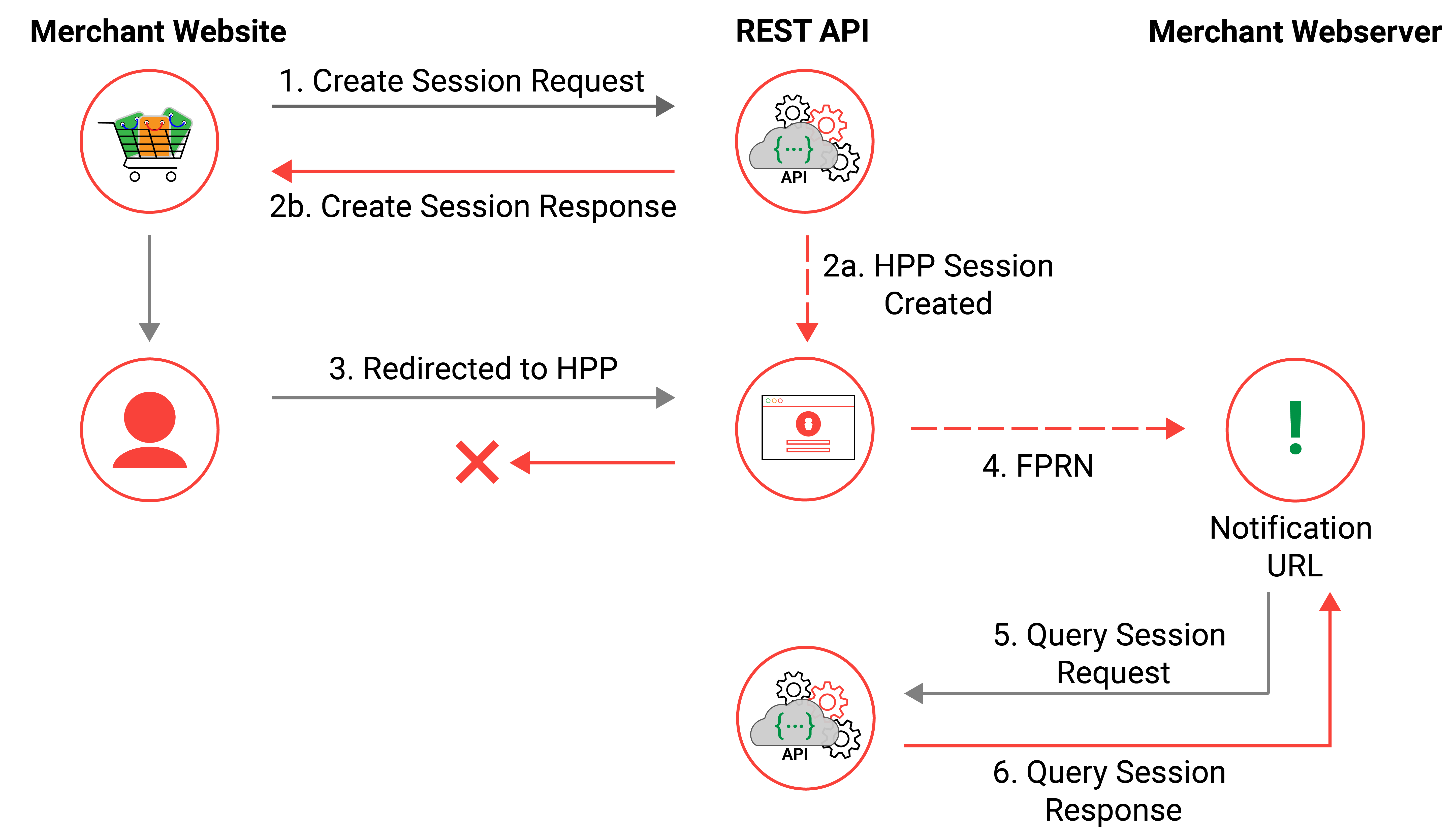

Server Side Walkthrough

The below flow diagram represents a high level server side post transaction flow from start to finish, more in-depth information for each stage of the flow is detailed in the next section.

Capturing Payment Information

In order to process payment the merchant webserver first needs to securely capture the customer's sensitive payment information, this is handled by the merchant but should meet PCI-DSS security standards to ensure customer's data is safe.

Create Transaction Request

In order to process payment for the user the merchant webserver must securely post the payment details to the Windcave host, this is achieved by submitting a Create Transaction request via the REST API. Below is an example of a simple create transaction request:

Endpoint:

POST https://sec.windcave.com/api/v1/transactions

Headers:

Content-Type:application/json

Authorization: Basic ABC123

Request Body:

{

"type": "purchase",

"amount": "12.34",

"currency": "NZD",

"merchantReference": "1234ABC",

"card": {

"cardHolderName": "JOHN T DOE",

"cardNumber": "4111111111111111",

"dateExpiryMonth": "01",

"dateExpiryYear": "22",

"cvc2": "111"

}

}

After sending the payment request the merchant webserver needs to obtain the transaction result so that the customer can be alerted of the outcome of their transaction.

In order to obtain the transaction result the merchant webserver needs to parse the create transaction response for the authorised field, this field will indicate true if the transaction was approved or false if the transaction was declined. Below is an example of a simple create transaction response:

HTTP Response Code:

201 Created

Response Body:

{

"id": "0000000c01541fe6",

"username": "TestUser",

"authorised": true,

"allowRetry": false,

"reCo": "00",

"responseText": "APPROVED",

"authCode": "011744",

"type": "purchase",

"method": "card",

"localTimeZone": "NZT",

"dateTimeUtc": "2020-07-02T02:18:26Z",

"dateTimeLocal": "2020-07-02T14:18:26+12:00",

"settlementDate": "2020-07-02",

"amount": "12.34",

"currency": "NZD",

"currencyNumeric": 554,

"clientType": "internet",

"merchantReference": "1234ABC",

"card": {

"cardHolderName": "JOHN T DOE",

"cardNumber": "411111........11",

"dateExpiryMonth": "01",

"dateExpiryYear": "22",

"type": "visa"

},

"cvc2ResultCode": "U",

"links": [

{

"href": "https://sec.windcave.com/api/v1/transactions/0000000c01541fe6",

"rel": "self",

"method": "GET"

},

{

"href": "https://sec.windcave.com/api/v1/transactions",

"rel": "refund",

"method": "POST"

}

]

}

In the event the transaction is still being processed by the parties involved the REST API will respond to the merchant webserver 10 seconds after the initial request was received, this ensures the merchant webserver has confirmation the request was received and has a means of checking the result once the transaction has been processed. Below is an example of a simple create transaction response where the transaction was not processed within the 10 seconds:

HTTP Response Code:

202 Accepted

Response Body:

{

"id": "0000000c015257e1",

"links": [

{

"href": "https://sec.windcave.com/api/v1/transactions/0000000c015257e1",

"rel": "self",

"method": "GET"

}

]

}

Once received the merchant webserver can periodically submit the query transaction request by reading the URL link where “rel” is “self”, the query transaction response will return a HTTP 202 Accepted response if the transaction is still being processed.

The query transaction response will return a HTTP 200 OK response if the transaction has finished processing. Below is an example of a query transaction response where the transaction has been processed:

HTTP Response Code:

200 OK

Response Body:

{

"id": "0000000c01541fe6",

"username": "TestUser",

"authorised": true,

"allowRetry": false,

"reCo": "00",

"responseText": "APPROVED",

"authCode": "011744",

"type": "purchase",

"method": "card",

"localTimeZone": "NZT",

"dateTimeUtc": "2020-07-02T02:18:26Z",

"dateTimeLocal": "2020-07-02T14:18:26+12:00",

"settlementDate": "2020-07-02",

"amount": "12.34",

"currency": "NZD",

"currencyNumeric": 554,

"clientType": "internet",

"merchantReference": "1234ABC",

"card": {

"cardHolderName": "JOHN T DOE",

"cardNumber": "411111........11",

"dateExpiryMonth": "01",

"dateExpiryYear": "22",

"type": "visa"

},

"cvc2ResultCode": "U",

"links": [

{

"href": "https://sec.windcave.com/api/v1/transactions/0000000c01541fe6",

"rel": "self",

"method": "GET"

},

{

"href": "https://sec.windcave.com/api/v1/transactions",

"rel": "refund",

"method": "POST"

}

]

}

In order to obtain the transaction result the merchant webserver needs to parse the query transaction response for the authorised field, this field will indicate true if the transaction was approved or false if the transaction was declined.

For more in-depth information on sending a create transaction request and processing the response please refer to the API reference documentation here.

Displaying The Transaction Result

After discovering the result of the transaction the merchant webserver is required to display the transaction result to the user, this can be done by simply redirecting the user to a success/failure page indicating the result of the payment but how this is managed is entirely up to the merchant's webserver.

Server Side Post & 3D Secure

Windcave is certified for Server Side Post 3D Secure with the 3RI (3DS Requestor Initiated) type of authentication, where transactions proceed without the customer’s direct involvement. 3RI is essentially back-end rebilling that follows a prior authentication via a front-end Customer Initiated Transaction (CIT) (i.e. 3DS authentication on a website, loading card onto an app etc).

Note: For 3RI to be allowed, there must have been a prior CIT authentication per scheme requirements, which is currently only supported with Windcave's Create Session solution.

Also known as Merchant-Initiated Authentication, 3RI enables seamless authentication methods such as Frictionless authentication or Decoupled authentication, where supported by the issuer/ACS.

For Frictionless flows, transactions are processed without customer interaction, while Decoupled authentication requires merchants to manage interim responses and actively poll for the final outcome to complete the transaction.

For more information, see Frictionless flows and Decoupled Authentication.

For more information about 3D Secure please see the 3D Secure section of this guide.

Server Side Post & FPRN

Fail Proof Result Notification (FPRN) helps ensure the merchant web application receives the payment outcome in scenarios such as; the merchant webserver being temporarily unavailable just prior to the transaction being processed.

The Server-Side Post solution supports FPRN and it is enabled by default for any new account setups, for further information please see Fail Proof Result Notification.

3D Secure

3D Secure (3DS) adds an additional level of authentication to help protect against fraudulent transactions by shifting liability to the issuing bank. This additional authentication may not require input from the cardholder, however when additional input is required the cardholder will typically be redirected to their issuers 3D Secure user interface; here the cardholder will be prompted to authenticate that they are the owner of the account.

The information required to authenticate the transaction will vary between different issuers, for example, approving via your banking / issuer mobile app, or an SMS code to the cardholder's registered mobile device.

Please note the 3D Secure authentication interface displayed to the cardholder is controlled by the individual issuers and cannot be customized by the merchant.

3D Secure is mandated by some acquirers, Windcave acquiring does mandate 3D Secure be enabled unless special dispensation is granted.

3D Secure v2

3D Secure version 1 was launched in 2001 to protect businesses and their customers from fraud. A re-direct to an authentication page with a password or code ensured a secure payment method before approving a purchase.

Due to the changes in the way that a customer makes online purchases, the expectations of a secure and frictionless experience have increased, and 3D Secure version 2 was introduced to meet these requirements.

3D Secure v2 aims to reduce the friction of authentication associated with its predecessor (3D Secure v1), by increasing data sharing between merchants and card issuers in a non-intrusive way and supporting modern authentication methods such as two-factor authentication (SMS and biometrics).

3D Secure v2 provides Strong Customer Authentication (SCA) compliant with European PSD2 regulations, for further information please see Strong Customer Authentication.

Liability Shift

Shifting liability from merchants to the card issuing banks is one of the key incentives provided to merchants for 3D Secure authenticated transactions, this is possible because of the additional authentication/checks done when processing 3D Secure transactions.

Please note the 3D Secure liability shift only affects fraudulent chargeback requests, there are other chargeback requests that are not applicable to the 3D Secure liability shift.

This liability shift is only applicable to the transaction where the 3DS validation checks were performed.

Merchants with 3D Secure enabled on their REST API user can review the liability shift status for each transaction, this is done by extracting the value of the liabilityIndicator field returned in the final payment response.

Merchants should not develop any conditional logic based on the liabilityIndicator field; this field is intended for reporting purposes only. If the liabilityIndicator is set to “Standard” this indicates no liability shift has taken place and standard liability applies, alternatively if 3D Secure has been successfully authenticated the liabilityIndicator value will be set to the appropriate value based on the liability shift.

Below is the set of values the merchant can expect for liabilityindicator:

- standard

- 3ds2frictionless

- 3ds2challenge

- 3ds2decoupled

3D Secure Authentication

With 3D Secure merchants have access to utilize browser-based authentication with pages better optimized for mobile support.

All 3D Secure authentication channels have Frictionless and Challenge based user experience, please refer to Frictionless vs Challenge for further information.

Browser-Based Authentication

Browser-based authentication embeds the 3D Secure challenge into an iFrame.

For HPP, this iFrame is located in the payment checkout so to the cardholder it appears as though they have not left the payment page. This increases cardholder confidence and aims to help reduce shopping cart abandonment for merchants.

For Form Post, depending how this is implemented, either the iFrame can be located in the payment checkout or a re-direct to 3DS page.

For AJAX Post, the merchant can decide where the 3DS url is directed and can re-direct or host 3DS within their iFrame.

Below is an example of the 3D Secure browser-based authentication user experience for PC:

Below is an example of the 3D Secure browser-based authentication user experience for Mobile:

Custom CSS iframe

For merchants using custom CSS, the iframe dimensions for 3D Secure need to be setup to normalize the 3DS page dimensions the card issuer loads for the iframed 3D Secure.

Below is the Windcave recommended line of Custom CSS with the div ID for the setup:

| Custom CSS for iframed 3DS | div#ThreeDSChallengeDiv {width: 100% !important;}iframe#ThreeDSChallengeIFrame{width:420px;height:570px;display: block;margin: 0 auto;} |

For more information on iframe css, please see iframe Embedded HPP (REST).

Decoupled Authentication

Decoupled authentication provides a secure and streamlined way for cardholders to verify transactions without direct involvement with the 3D Secure requestor. This method allows the authentication process to occur separately and independently through the issuer’s ACS (Access Control Server).

The ACS facilitates this process, often through push notifications sent to the cardholders banking app. This notification prompts the cardholder to authenticate the payment via their chosen method of authentication.

The timeout period for the cardholder to respond and confirm the Decoupled authentication request is configurable by Windcave, with a default setting of 10 minutes.

Once the authentication process is finalized, the ACS communicates the results and liability shift to the merchant, enabling the transaction to proceed. By handling the authentication externally, it minimizes friction for the cardholder while maintaining high security standards.

Out of Band Authentication

Out of band (OOB) authentication is one of the possible methods/channels methods issuers can use to authenticate the 3D Secure challenge, it allows issuers to process the authentication outside of the merchants shopping environment.

An example of out of band authentication would be if the 3D Secure challenge page triggered a push notification to the issuers mobile banking app to authenticate the payment, in this scenario the cardholder may be prompted on the challenge page on their device, to open their issuers banking app to approve the payment.

Out of band authentication may be performed using a single device i.e. using the same device to access the merchant payment page and authentication application, or multiple devices i.e. using a PC’s web browser to process payment but authenticating through issuers banking application on mobile.

In both single and multiple device scenarios there is no additional implementation required by the merchant webserver, the out of band authentication will be handled by the issuer once customer is redirected to the 3D Secure challenge page.

Frictionless vs Challenge

When processing 3D Secure transactions there are two transaction flows the cardholder could experience. Which experience the cardholder sees is dependent on the risk level determined by the algorithm settings the particular issuer instructs their Access Control Server (ACS) to use. The ACS assesses the risk level based on various data elements including card holder's transaction history and transaction information provided by the 3D Secure Requestor and Merchant webserver.

If the risk assessment deems the transaction is low risk, the cardholder will experience a Frictionless flow. The Frictionless flow is where no further authentication is required by the cardholder and payment will process as normal i.e. after entering payment details cardholder will be redirected to the transaction result page.

If the risk assessment deems the transaction is high risk, the cardholder will experience a Challenge flow. The Challenge flow is where the cardholder will be presented with a challenge (varies between issuers), this challenge will require the cardholder to further authenticate they are the owner of the account. Once authenticated the transaction will proceed as normal i.e. cardholder will be redirected to the transaction result page.

3D Secure v2 introduces new required and optional data that merchants can either obtain from the cardholder or can configure the payment page to prompt for the data, which Windcave then passes on in the Authentication request. Examples of this information would be the card holder's shipping address, their phone number or their email address. The ACS will also automatically look at the card holder's payment history with the merchant and other merchants, but this requires no action from the merchant. All these factors are used by the issuers' ACS to assess risk of the transaction in real time.

By sharing additional data between the merchant and issuer, merchants can help reduce the chance of friction for their customers when making purchases online. Please refer to 3D Secure Fields for details on optional information that can be provided in the transaction request.

3D Secure v2 Challenge Preference

Merchants with 3D Secure have the option to indicate their challenge preference when processing transactions, whether it be a known customer and prefer not to challenge or based on the items ordered a challenge is preferred to be safe.

This is achieved by adding the challengeIndicator optional field to the Create Session REST API request, for a full list of available values please see Create Session. Below is an example of a simple Create Session request where challenge is preferred:

Endpoint:

POST https://sec.windcave.com/api/v1/sessions

Headers:

Content-Type:application/json

Authorization: Basic ABC123

Request Body:

{

"type": "purchase",

"amount": "1.00",

"currency": "NZD",

"merchantReference": "1234ABC",

"callbackUrls": {

"approved": "https://example.com/success",

"declined": "https://example.com/fail",

"cancelled": "https://example.com/cancel"

},

"notificationUrl": "https://example.com/txn_result?123",

"threeds": {

"challengeIndicator": "challengepreferred"

}

}

Non-Payment Authentication

Non-Payment Authentication (NPA) is the process of separating the 3D Secure Authentication from the payment experience, this is where the cardholder can be Authenticated prior to reaching the checkout and make the cardholder experience less stressful when making payment. Note that this process is to confirm the cardholder's account; This does not provide a liability shift for subsequent transactions using that stored token.

An intention of Non-Payment Authentication is to get the Access Control Server (ACS) to trigger a Challenge for a $0 token-creating authentication that may otherwise be authenticated as Frictionless, as the zero amount means it is below the threshold that would trigger a Challenge. Non-Payment Authentication increases the chance of a Challenge but does not guarantee it.

Examples of where Non-Payment Authentication may be used include:

- When a card is loaded onto a Mobile App, where the payment is not taken at the time of loading.

- Other use cases requiring the creation of a credit card token, where this token may be used for rebilling when a customer is signing up for a 'credential on file' or subscription-based service.

For merchants the setup process simply involves using a Non-Payment transaction type such as Validate.

Please note Non-Payment Authentication is not enabled by default. If you would like to have this enabled, please contact [email protected].

Validate

A Validate transaction type is used with the amount $0.00 (zero hold/no hold) to validate that the card sent, including expiry date, are valid with the acquirer and bank.

Often this is utilized to initially store a card as a token for future card rebilling with a token.

Strong Customer Authentication

As of September 14th, 2019, new rules were introduced for merchants/customers transacting within the European Economic Area (EEA), this was introduced under the legislation known as the Payment Service Directive (PSD) 2. The PSD2 legislation has a specific focus on payments through its regulations on Strong Customer Authentication (SCA).

For a transaction to be compliant under the new rules/regulations, Strong Customer Authentication (SCA) requires transactions meet at least two of the three components listed below. These are commonly referred to as two-factor authentication (2FA) or multi-factor authentication (MFA).

|

Knowledge Something your customer knows e.g. a PIN code or password |

|

Possession Something your customer has e.g. a credit card or electronic device |

|

Inherence Something your customer is e.g. a fingerprint or facial recognition |

SCA makes transacting online more secure and helps reduce fraud. If you would like to read more about SCA requirements the Regulatory Technical Standards outlines the SCA guidelines here

Transactions not meeting SCA criteria where SCA is required will start being declined by the issuing bank. It is recommended merchants introduce SCA to reduce unwanted declines.

Windcave recommend implementing 3D Secure v2, Strong Customer Authentication (SCA) through 3D Secure as this is compliant with European PSD2 regulations.

SCA Exemptions

There are certain exemptions whereby transactions may not require SCA when processing, however this does mean that SCA cannot be applied for charge back protection. These exemptions include:

- Low Value Transactions (under €30 each)

- Fixed amount subscriptions

- Trusted beneficiaries

- MOTO and commercial payments

- Merchant-initiated transactions (MIT’s)

These exemptions can be requested by the merchant or acquirer, in which case the liability will stay with the merchant/acquirer.

However, even when not explicitly requested by the merchant/acquirer, some of these exemptions may still be applied by the issuer to avoid SCA friction. In these scenarios the liability remains with the issuer.

Low Value Transactions

Transactions under €30 each are exempt from SCA. The issuing bank will keep track of how many payments are made using this exemption.

Fixed Amount Subscriptions

Regular, fixed-amount transactions are exempt from SCA from the second transaction onwards.

The initial transaction and any change in the transaction amount requires SCA.

Note – in cases that these are flagged as merchant-initiated please refer to the MIT section below.

Trusted Beneficiaries

These are certain trusted merchants that are chosen by the cardholder.

Customers can assign businesses to a whitelist of trusted beneficiaries. This list is maintained by the customers’ bank and can be exempt from SCA.

This allows regular customers to usually skip SCA with the businesses they’ve chosen to whitelist.

MOTO and commercial payments

Mail Order and Telephone Order (MOTO) payments are exempt from SCA as they are not considered electronic payment types.

Merchant-Initiated Transactions (MIT’s)

MIT’s are transactions that have no direct customer involvement. Payment is taken from a securely saved card (with customers prior consent).

The first payment taken will be authenticated with SCA, however the following payments will be flagged as ‘Merchant Initiated Transaction’, therefore exempt from SCA.

For a payment to be categorized as a merchant-initiated transaction, the merchant must:

- Be approved by the customer to initiate the payment or series of payments.

- Initiate the payment without specific action from the customer to trigger the payment request.

Merchant requested vs Automatic exemptions

Merchant requested exemptions have a higher priority than automatic exemption. If the user has both automatic exemptions and merchant-requested exemptions, the Windcave system will use automatic exemptions only if there is no exemption in the New Session request.

Merchant-Requested Exemptions

Merchant-requested exemptions are a type of acquirer exemption that can be used to bypass Strong Customer Authentication (SCA) for certain online and contactless purchases.

A merchant can manually request an exemption using a REST Create Session where they can add the field threeds/scaExemption to specify the exemption type.

threeds/scaExemption

Implementing 3D Secure exemptions requires your REST API username be enabled for exemption functionality. If you are unsure or would like to enquire about adding 3D Secure exemptions to your REST account, please contact us.

Allowed values are:

- no

- mit

- tra

- recurring

- lowvalue

- scadelegation

- securecorporatepayment

Below is an example of a REST API Create Session request with merchant-requested exemption:

Endpoint:

POST https://sec.windcave.com/api/v1/sessions

Headers:

Content-Type:application/json

Authorization: Basic ABC123

Request Body:

{

"type": "purchase",

"methods": ["card"],

"amount": "1.06",

"currency": "AUD",

"threeds": {

"scaExemption": "securecorporatepayment"

},

"callbackUrls": {

"approved": "https://example.com/success",

"declined": "https://example.com/fail",

"cancelled": "https://example.com/cancel"

},

"notificationUrl": "https://example.com/txn_result?123"

}

Testing 3D Secure

Before proceeding with testing please follow the instructions in the Overview to sign up and receive your Windcave REST API development account. Please note 3D Secure is not enabled on test accounts by default, if you would like to enable 3D Secure, please contact [email protected].

Once enabled on the REST user the User Acceptance Testing (UAT) host can simulate the 3D Secure transaction process, this is triggered by using one of the below test cards at checkout:

| Test Card Number | Expiry Date | CVC | 3D Secure v2 Challenge Code |

|---|---|---|---|

| 5588 8800 0007 7770 | Any valid expiry date | Any 3 digits | 123 |

| 4111 1111 1111 1111 | 12/30 | Any 3 digits | Frictionless |

If you have any questions or encounter any issues while attempting to test 3D Secure please contact [email protected] and include your REST API username.

3D Secure Fields

3D Secure v2 introduces new fields that can be included in the Create Session requests. Merchants can use these fields to provide further information about the consumer making the payment or indicate their preference for the 3D Secure challenge.

Best practice from schemes is to include the customer email, billing and shipping address to improve the chances for a frictionless flow. If this information is included, Windcave recommends this data is validated before submitting the form.

Note that some business models may only require a billing address, however including all customer information where possible is recommended.

For more in-depth information on sending a Create Session request and processing the response, please refer to the API reference documentation.

Mandatory Fields

The below fields are mandated by schemes and must be populated when processing 3DS transactions:

Populated in the Create Session request:

- Customer Email Address and/or Customer Phone Number (Work / Home / Mobile - at least one of these fields must be provided)

Populated when submitting payment information

- Cardholder Name (Captured by Windcave in Hosted Payment Page, for AJAX POST or Form Post merchant webserver must submit as in the FORM POST or AJAX POST from client-site)

The below fields although optional are also highly recommended, including these fields will increase the likelihood of 3D Secure being Frictionless during checkout for your customers:

- Customer Billing Address City

- Customer Billing Address Country

- Customer Billing Address Line 1

- Customer Billing Address Postal Code

- Customer Billing Address State

Below is an example of a simple Create Session request with mandatory 3D Secure fields.

Endpoint:

POST https://sec.windcave.com/api/v1/sessions

Headers:

Content-Type:application/json

Authorization: Basic ABC123

Request Body:

{

"type": "purchase",

"amount": "123.00",

"currency": "AUD",

"merchantReference": "1234ABC",

"callbackUrls": {

"approved": "https://example.com/success",

"declined": "https://example.com/fail",

"cancelled": "https://example.com/cancel"

},

"customer": {

"email": "[email protected]",

"phoneNumber": "+6421123456",

"homePhoneNumber": "+649123456",

"billing": {

"name": "John Doe",

"address1": "123 Test Street",

"city": "deliverytown",

"countryCode": "NZ",

"postalCode": "90210",

"state": "Akl"

}

}

}

Optional Fields

Adding the 3D Secure Optional fields simply requires the merchant webserver to include the threeds array with the fields they opt to include in the Create Session request.

Below is an example of a simple Create Session request with optional 3D Secure fields.

Endpoint:

POST https://sec.windcave.com/api/v1/sessions

Headers:

Content-Type:application/json

Authorization: Basic ABC123

Request Body:

{

"type": "purchase",

"amount": "123.00",

"currency": "AUD",

"merchantReference": "1234ABC",

"callbackUrls": {

"approved": "https://example.com/success",

"declined": "https://example.com/fail",

"cancelled": "https://example.com/cancel"

},

"customer": {

"email": "[email protected]",

"shipping": {

"name": "John Doe",

"address1": "123 Test Street",

"address2": "",

"address3": "",

"city": "Auckland",

"countryCode": "NZ",

"postalCode": "1010",

"phoneNumber": "+6491231234",

"state": ""

},

"billing": {

"name": "John Doe",

"address1": "123 Test Street",

"address2": "",

"address3": "",

"city": "Auckland",

"countryCode": "NZ",

"postalCode": "1010",

"phoneNumber": "+6491231234",

"state": ""

}

},

"notificationUrl": "https://example.com/txn_result?123",

"threeds": {

"challengeIndicator": "challengepreferred",

"accountID": "123456789",

"accountInfo":{

"accountAgeIndicator": "thistransaction",

"accountChangeDate": "2023-07-26",

"accountChangeIndicator": "morethan60days",

"accountOpeningDate": "2020-01-01",

"passwordChangeDate": "2023-01-02",

"passwordChangeIndicator": "lessthan30days",

"purchasesCount": "20",

"provisionAttemptsPerDay": "0",

"transactionsPerDay": "1",

"transactionsPerYear": "12",

"paymentAccountEnrollmentDate": "2020-01-01",

"paymentAccountAgeIndicator": "morethan60days",

"shippingAddressFirstUsageDate": "2020-01-02",

"shippingAddressFirstUsageIndicator": "morethan60days",

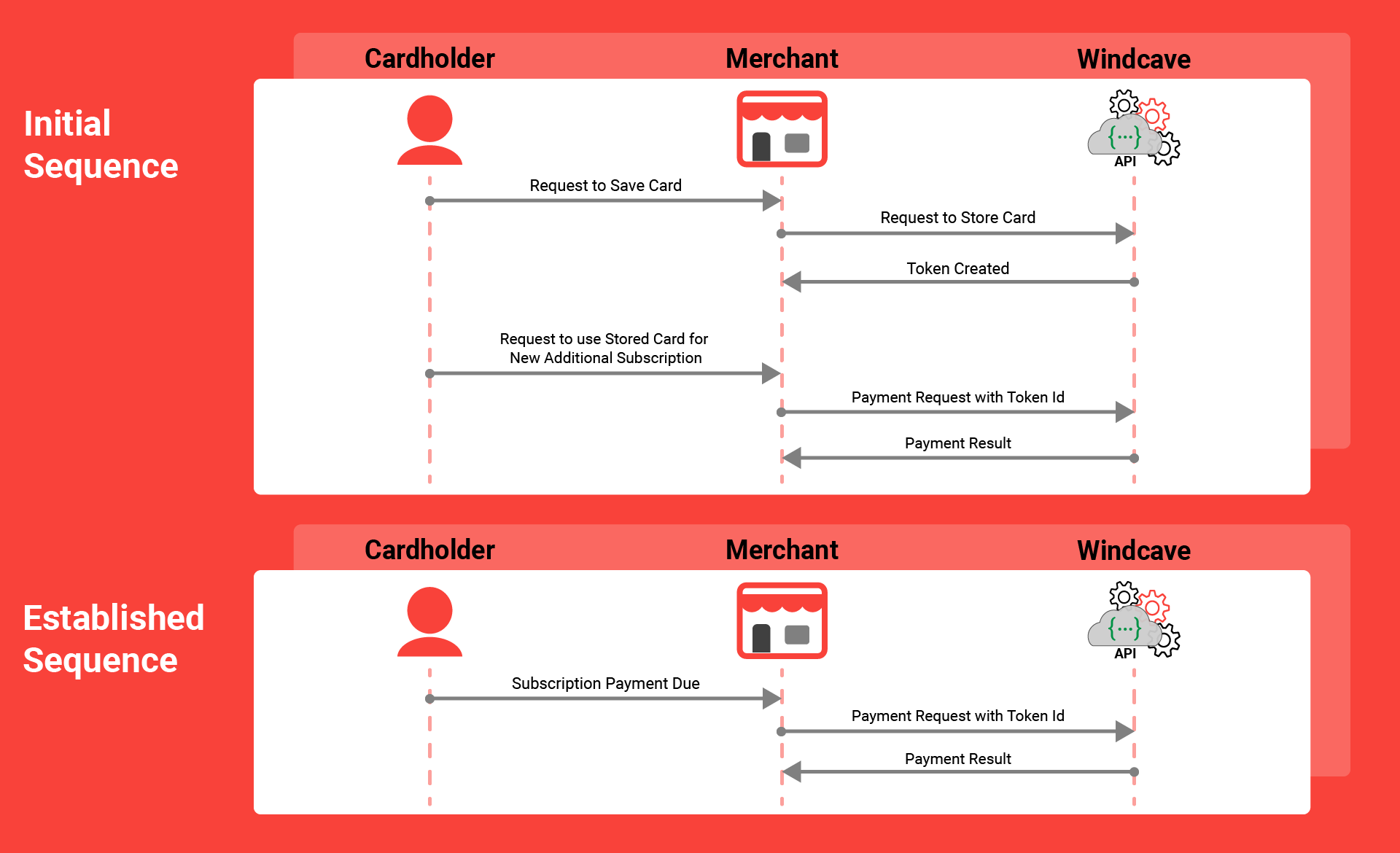

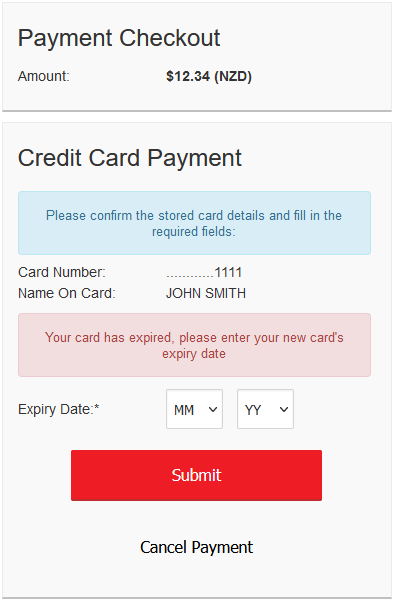

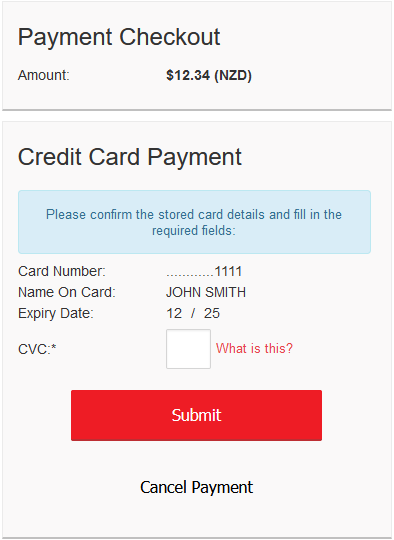

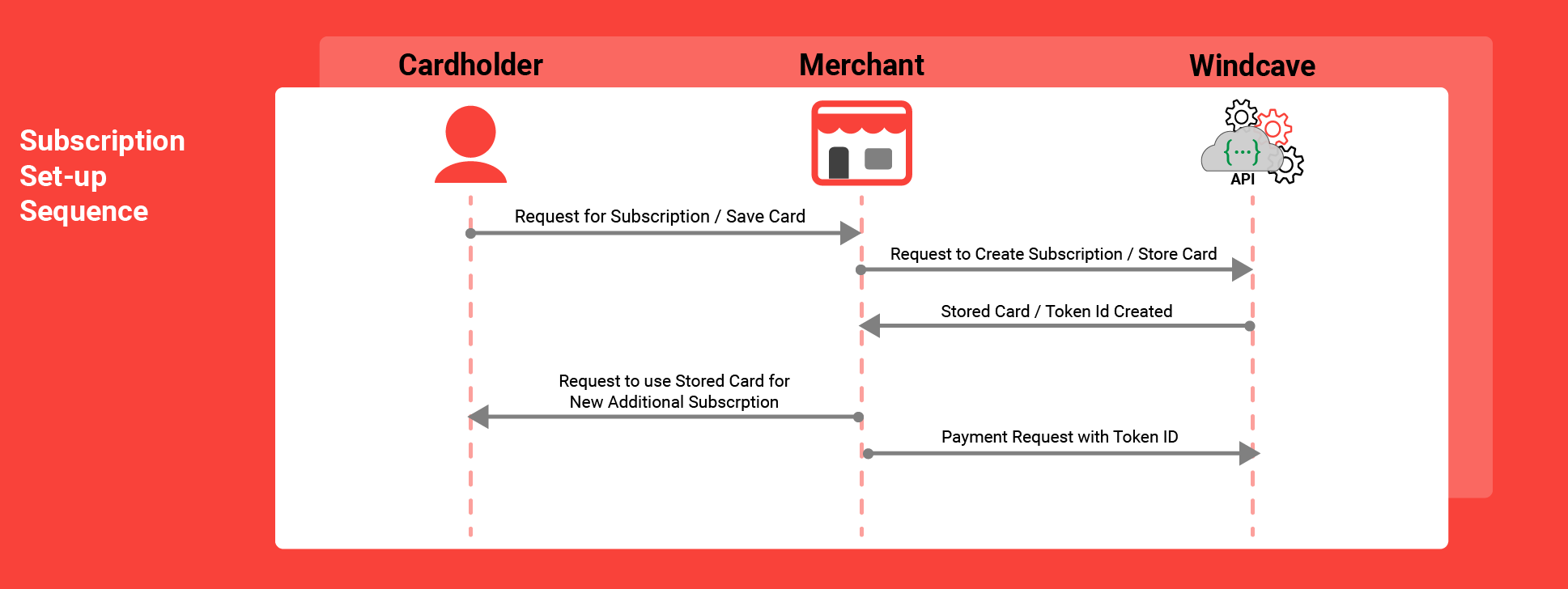

"shippingNameIndicator": "different"