HeroImage

Features / Fraud Prevention

Fraud Prevention

Protect against fraud and chargebacks.

Minimize fraudulent transactions and disputes by using the latest technology and customizable risk management tools.

Manage All Your Risk Settings In One Place.

Access and monitor all transactions through your online Payline portal. Identify fraudulent behavior and setup custom risk rules to mitigate future attempts, block stolen cards or use Windcave’s risk scoring algorithm built from analyzing the millions of transactions processed through us.

Risk Scoring

Custom Risk Rules

Authentication

area-grey

Intelligent Risk Algorithms

Windcave's sophisticated risk scoring rules provide a feature-rich solution to analyze and protect your business from the ever evolving threat of fraud.

Smart Individual Authentication

3D Secure authentication adds an extra layer of security at the point of purchase by authenticating a cardholders identity. Authentication can occur seamlessly for the cardholder by using the known information provided within the transaction data.

Transactions successfully authenticated via 3D Secure protect the merchant from fraud chargebacks, by shifting liability from them to the card issuer.

Learn more about 3D Secure through our FAQs.

area-grey

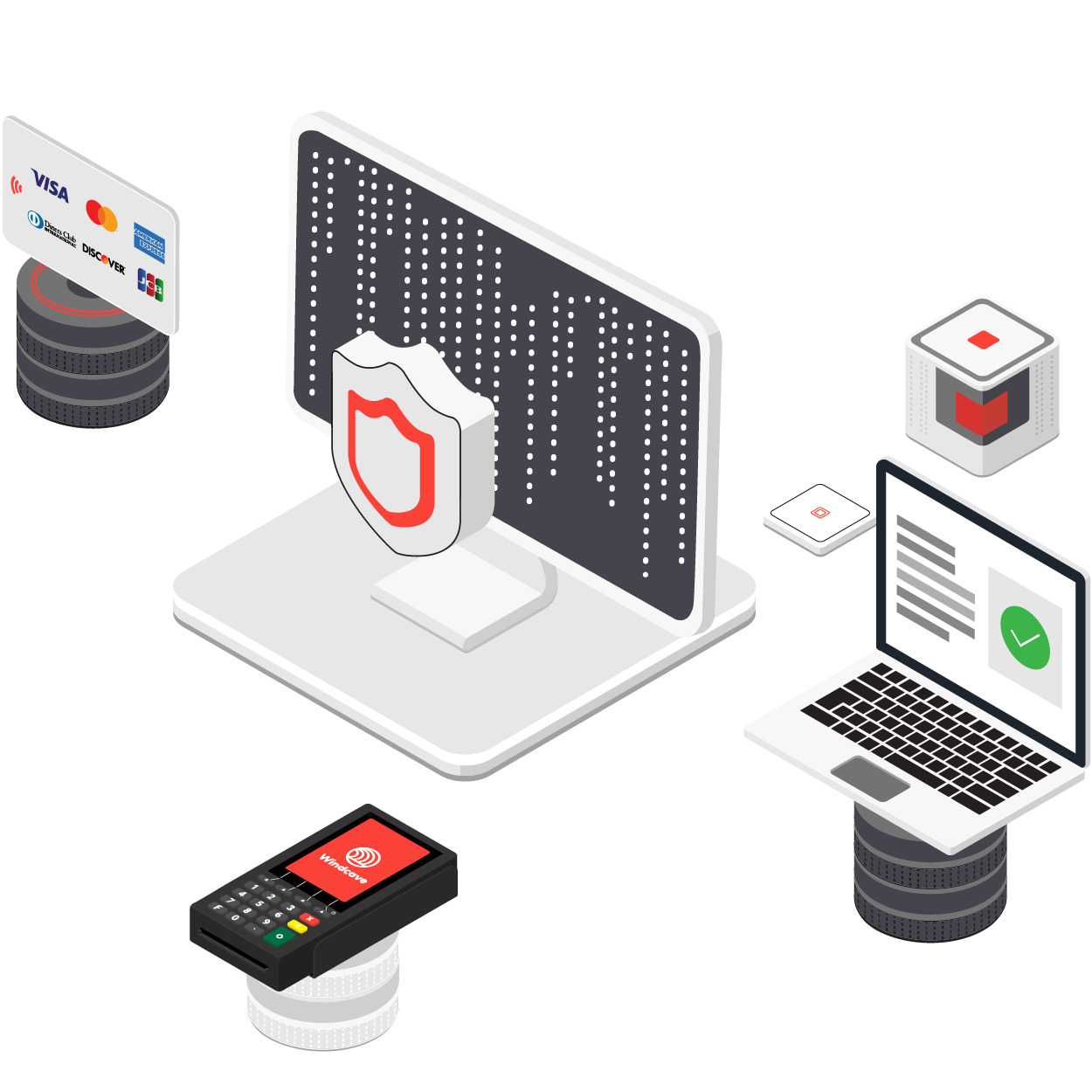

Protect From Any Device. Anywhere.

Access and monitor all transactions through your online Payline portal. Identify fraudulent behavior and setup custom risk rules to mitigate future attempts, block stolen cards or use Windcave’s risk scoring algorithm built from analyzing the millions of transactions processed through us.

Up To Date Security And Encryption.

All Windcave payment terminals are tamper-resistant with built-in EMV chip and pin technology. Windcave terminals also comply with the highest standards including EMVCo L1 & L2, PTS 6.x and Point-2-Point Encryption so transaction data is fully secured and merchants are protected from chargeback liability.